Click for best price

Click for best price

Industry Overview

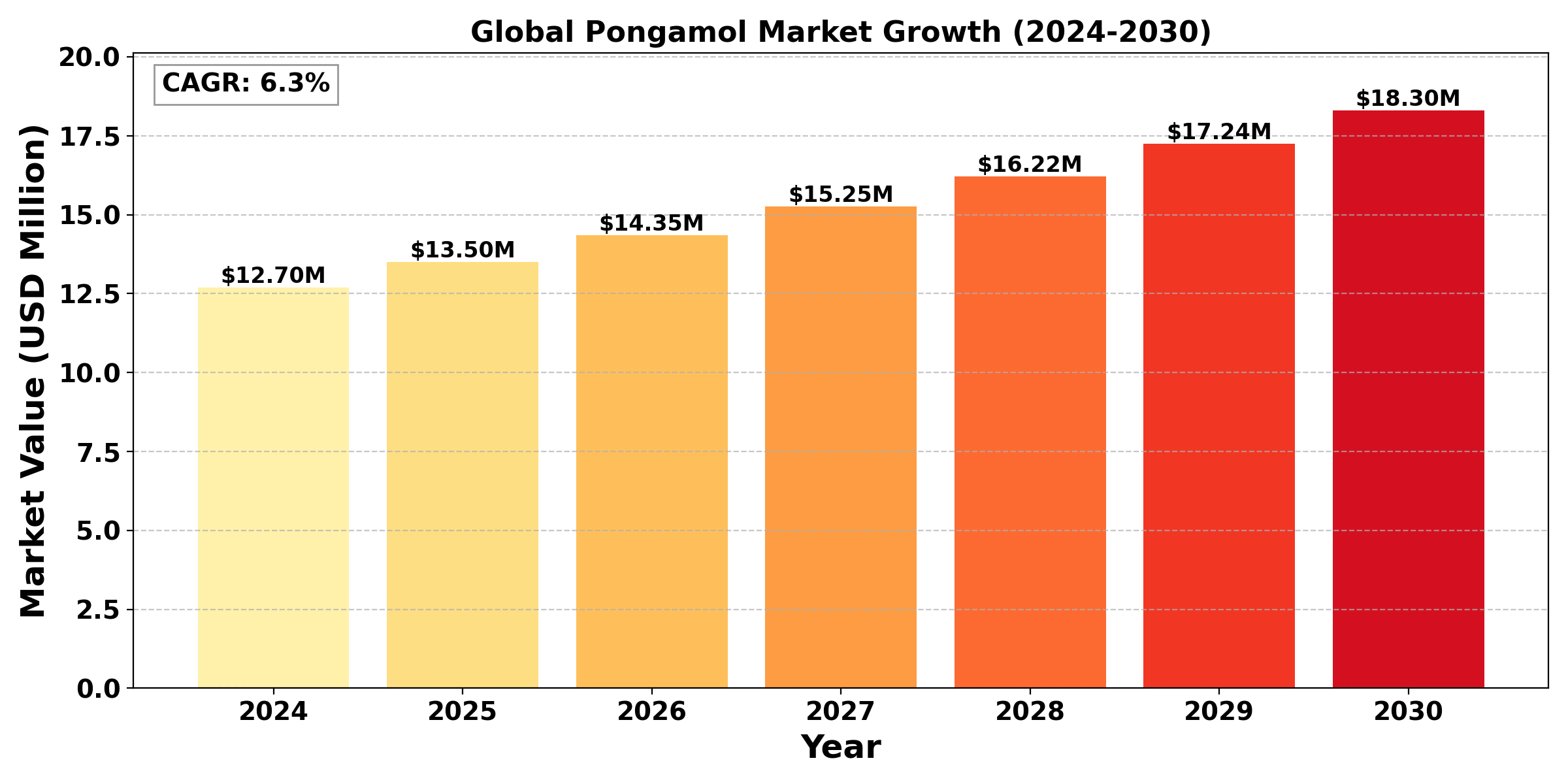

The "Global Pongamol Market" size was valued at US$ 12.7 Million in 2024 and is projected to reach US$ 18.3 Million by 2030, at a CAGR of 6.3% during the forecast period 2024-2030.

Pongamol is a flavonoid compound extracted from the seeds of Pongamia pinnata (Indian beech). It has the molecular formula C18H14O4 and is known for its potential therapeutic properties.Pongamol, a substance made from the seeds of the Pongamia pinnata tree, is produced and used in the pongamol business, which is a subset of the larger bio-based chemicals industry. Pongamol is becoming more well-known for its potential as a sustainable substitute for chemicals generated from petroleum, particularly in the manufacturing of lubricants, biodiesel, and other industrial uses. Interest in pongamol and its derivatives is being fueled by the desire to lessen reliance on fossil fuels and the increasing emphasis on renewable resources.

Pongamol is seen as a viable feedstock for a number of industries, including agrochemicals, pharmaceuticals, cosmetics, and the automotive sector, due to its natural and biodegradable nature. It can be formulated into high-performance lubricants and additives because to its special qualities, which include good lubricity and thermal stability, meeting the growing demand for environmentally friendly products.

Geographically, the market is most prominent in regions with abundant pongamia trees, such as India and Southeast Asia, where local cultivation supports the supply chain. However, the pongamol market is still emerging, facing challenges such as limited awareness of its benefits and competition from established synthetic alternatives. Nonetheless, ongoing research and development efforts aim to enhance the extraction processes and expand its applications, positioning pongamol for growth in the evolving landscape of sustainable chemicals.

Segmental Analysis

≥99% purity holds the highest market: By Type

In the pongamol market, the segment of ≥99% purity holds the highest market share compared to the <99% purity segment. This high-purity pongamol is increasingly preferred in various applications, particularly in industries that require specific quality standards, such as pharmaceuticals, cosmetics, and high-performance lubricants. The demand for ≥99% purity pongamol is driven by its superior properties and consistent performance, making it suitable for formulations where quality and effectiveness are critical. For instance, in the cosmetic and personal care sectors, high-purity pongamol is valued for its natural origin and beneficial attributes, contributing to the growing trend toward clean and sustainable ingredients.

Moreover, stringent regulatory standards in many industries further propel the demand for high-purity products, as manufacturers seek to comply with safety and quality regulations. While the <99% purity segment may cater to certain applications, it is the ≥99% purity pongamol that is capturing the majority of market interest and investment, positioning itself as the preferred choice among consumers and manufacturers seeking reliable and high-quality bio-based solutions.

Cosmetic and Personal Care to hold the highest Market share

In comparison to the pharmaceutical and organic synthesis divisions, the cosmetics and personal care category has the largest market share in the pongamol industry. The use of pongamol, which is prized for its advantageous qualities like anti-inflammatory and antioxidant activities, has increased dramatically in response to the growing demand for sustainable and natural components in cosmetic formulations.

Cosmetics makers are using pongamol in a variety of formulas, such as moisturizers, serums, and hair care products, as customers place a greater value on eco-friendly and clean products. Because of its natural origin, it fits in well with the growing trend of employing plant-based products, which appeals to consumers who care about the environment.

Furthermore, despite its importance, the pharmaceutical segment only accounts for a smaller portion of the market because of the strict regulations and particular formulations required for drug development. Similar to this, pongamol may find usage in organic synthesis, although this market is still in its infancy and does not yet rival the wide range of uses found in personal care and cosmetics.

Due to consumer product trends that emphasize natural ingredients and sustainable sourcing, the cosmetics and personal care sector is currently leading the pongamol industry.

Regional Overview

The global chlor-alkali membranes market is experiencing diverse growth across regions. North America leads, driven by stringent environmental regulations and advancements in membrane technology. Europe follows, with a strong emphasis on sustainability and energy-efficient processes. Europe market for Pongamol is estimated to increase from 1.02 million USD in 2024 to reach 1.36 million USD by 2030, at a CAGR of 4.91% during the forecast period of 2024through 2030.

The Asia-Pacific region, particularly China and India, showcases significant growth potential due to rapid industrialization and increasing demand for chlor-alkali products in various sectors. Asia-Pacific market for Pongamol is estimated to increase from 1.80 million USD in 2024 to reach 2.33 million USD by 2030, at a CAGR of 4.40% during the forecast period of 2024 through 2030.Meanwhile, Latin America and the Middle East are gradually adopting membrane technologies, supported by investments in infrastructure and manufacturing. Overall, regional dynamics are influenced by regulatory frameworks, industrial demands, and technological advancements, shaping the market landscape.

Competitive Analysis

Recent Development

➣ October 29, 2024, Camber Pharmaceuticals has been working towards expanding its product portfolio.Camber is excited to announce the introduction of 8 new generic products to our growing portfolio during the third quarter of this year. These launches mark a significant step forward in our ongoing mission to provide patients and healthcare providers with high-quality, cost-effective alternatives to brand-name medications.

Industry Dynamics

Industry Drivers

Growing consumer demand for natural and sustainable products

A significant driver of the pongamol market is the growing consumer demand for natural and sustainable products. As awareness of environmental issues and health concerns increases, consumers are increasingly turning to products that are derived from renewable resources rather than synthetic chemicals. This shift is particularly pronounced in industries such as cosmetics, personal care, and pharmaceuticals, where the trend towards clean beauty and natural formulations is gaining traction. Manufacturers are responding by incorporating bio-based ingredients like pongamol into their products, leveraging its natural properties and benefits. This trend not only caters to consumer preferences but also aligns with regulatory pressures and sustainability initiatives aimed at reducing the environmental footprint of products.

Consequently, the rising demand for natural and sustainable ingredients is fueling the growth of the pongamol market, driving innovation and expansion in its applications across various industries.

Industry Trend

Emphasis on environmentally friendly production techniques

The growing emphasis on environmentally friendly production techniques and sustainable sourcing is one noteworthy development in the pongamol market. The use of renewable raw materials with low ecological impact is becoming more and more important as both consumers and businesses grow more environmentally conscientious. In addition to being sustainable, pongamia pinnata trees—the source of pongamol—also favor biodiversity and soil health.

Developments in extraction and processing methods that increase pongamol production's output and efficiency while reducing waste and energy use further support this trend. Businesses are using green chemistry concepts more and more to make sure that their manufacturing procedures support the objectives of environmental sustainability. Furthermore, pongamol's incorporation into a variety of formulations—especially in cosmetics and personal care items—reflects a larger movement toward ingredient sourcing transparency and clean labeling. In an effort to attract health-conscious customers looking for products that are safe for their skin and the environment, brands are aggressively marketing the usage of natural ingredients. All things considered, the market for pongamol is being shaped by the trend toward sustainability and eco-friendly practices, which is also promoting innovation and broadening its uses in a variety of industries.

Industry Restraint

Limited awareness about product benefit

The lack of knowledge and comprehension of pongamol's advantages among producers and consumers is a major barrier to the market. Many potential consumers are still ignorant of pongamol's special qualities and uses, despite the growing interest in sustainable and natural components. Its adoption in a variety of industries may be hampered by this ignorance, especially in areas where conventional synthetic alternatives are well-established.

Furthermore, compared to easily accessible synthetic alternatives, the extraction of pongamol can be a complicated and resource-intensive procedure, resulting in higher production costs. Pongamol's market penetration may be constrained by this expensive hurdle, which may discourage startups or smaller producers from incorporating it into their product lines.

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Type, Application. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

|

Attributes |

Details |

|

Segments |

By Type

By Application

|

|

Region Covered |

|

|

Key Market Players |

|

|

Report Coverage |

|

| Report Attributes | Report Details |

|---|---|

| Report Title | Pongamol (CAS 484-33-3) Market, Global Outlook and Forecast 2024-2030 |

| Historical Year | 2018 to 2022 (Data from 2010 can be provided as per availability) |

| Base Year | 2023 |

| Forecast Year | 2031 |

| Number of Pages | 101 Pages |

| Customization Available | Yes, the report can be customized as per your need. |

Frequently Asked Questions ?