Click for best price

Click for best price

Industry Overview

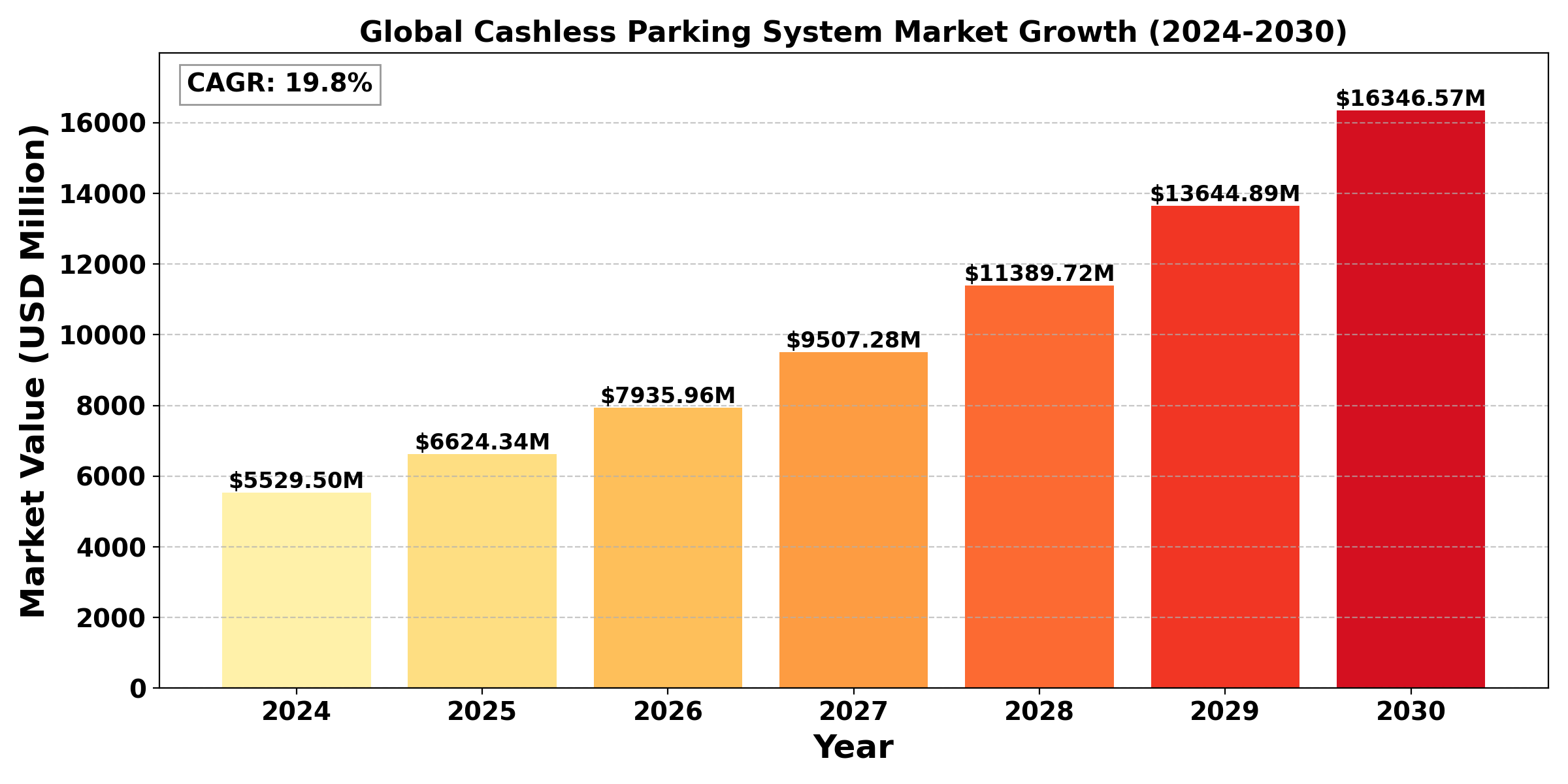

The "Global Cashless Parking System Market" was valued at US$ 5,529.50 million in 2024 and is projected to reach US$ 16346.57 million by 2030, at a CAGR of 19.80% during the forecast period.

The market for cashless parking systems has been expanding swiftly owing to the rise in demand for contactless, convenient solutions and the development of digital technologies. Mobile applications, QR code systems, license plate recognition, and payment kiosks are just a few of the technologies used in this sector to make parking charge transactions easier and eliminate the need for actual currency. The need for effective parking solutions that ease traffic and enhance user experience has increased due to urbanization and the rise in vehicle ownership, especially in areas with high population densities. Additionally, since communities and consumers alike place a higher priority on efficiency and sanitation, the COVID-19 pandemic has accelerated up the transition to contactless payments.

In order to incorporate cashless solutions into current systems, parking technology suppliers, app developers, and infrastructure businesses are important players in the sector. The necessity for compatibility across various payment and parking platforms, high initial implementation costs, and cyber security issues are some of the industry's other difficulties. The market for cashless parking systems is anticipated to increase significantly as cities and businesses look to improve mobility and implement smart city technologies, especially in developed and urbanized areas.

Segmental Analysis

Software base to hold the highest market share: By Type

Software-based solutions are increasingly gaining market share, according to the market segmentation of cashless parking systems into hardware-based and software-based solutions. Because they are flexible, affordable, and easy to use, software-based systems are highly sought after. These solutions, which enable smooth transactions and provide real-time data, remote management, and analytics capabilities, include cloud-based software, web-based platforms, mobile applications, and QR code payment systems. With the help of these capabilities, parking operators can keep an eye on available spaces, adjust prices, and gain insights into usage trends—all of which are crucial for increasing revenue and streamlining operations. Software-based systems are also preferred by customers due to their ease of use; they offer a variety of digital payment methods and enable smartphone payments, meeting the changing needs of customers for contactless, mobile solutions.

Even though they are essential to the infrastructure, hardware-based solutions—like automated pay stations, license plate recognition software, and entry/exit barriers—generally have a smaller market share than software. This is because hardware comes with higher upfront, installation, and continuing maintenance costs. Furthermore, in contrast to software solutions that can be updated remotely, hardware may be more difficult to update or modify to provide new features. Hardware, however, is crucial in complex parking situations or high traffic areas where physical control points are necessary for enforcement, safety, and car monitoring.

Commercial parking to hold the highest market share: By application

Commercial parking applications have the largest market share in the cashless parking system sector. This is mostly because commercial zones—such as shopping malls, office buildings, airports, entertainment venues, and core urban areas—have high traffic and turnover. In order to handle the large number of vehicles and satisfy the demand for quick, easy, and contactless payment methods, these settings call for effective and adaptable parking solutions. In commercial parking environments, cashless solutions improve the user experience by cutting down on wait times and enabling payments via a variety of digital channels, which is becoming more and more common among customers.

Hospital parking also accounts for a significant share since healthcare organizations place a high value on effective parking management in order to serve patients, employees, and guests. In hospitals, where reducing touch points is crucial for safety and hygiene and since vehicle turnover is quick, a seamless payment process is necessary to prevent traffic. This is where cashless systems come in handy.

Despite being necessary for gated communities and apartment complexes, residential parking holds a smaller market share because of generally lower vehicle turnover and the requirement for specialized, frequently subscription-based parking spaces rather than frequent cashless transactions. Similarly, because school parking mostly consists of defined parking arrangements for staff and kids, with peak usage during specified times, there is less demand for cashless systems.

Regional analysis

Growing urbanization, rising car ownership, and government initiatives to update infrastructure in nations like China, Japan, India, and South Korea have all contributed to the significant expansion of the Asia-Pacific industry. As part of broader programs for digital transformation and smart cities, these areas are rapidly implementing cashless technologies. Although adoption is still in its infancy, Latin America and the Middle East and Africa exhibit encouraging development potential. With the increasing use of mobile payments, especially in cities, Latin America is progressively shifting toward cashless alternatives. As the Middle East continues to invest in cutting-edge infrastructure, smart city initiatives in nations like Saudi Arabia and the United Arab Emirates are anticipated to propel future expansion. In general, the expansion of cashless parking systems across regions is indicative of the level of digital maturity in each location.

Regional preferences for digital payments, urbanization, and technology adoption are the main factors driving the market for cashless parking systems, which exhibits diverse growth patterns across different areas. Due to its extensive use of cashless payment technology, strong digital infrastructure, and high smartphone penetration, North America dominates the market. Cashless parking has grown significantly in the United States, especially in urban areas where effectively handling the high demand for parking is crucial. Because of its robust smart city efforts and government policies supporting sustainable urban mobility solutions, Europe also retains a sizable stake. Cashless parking systems are being quickly implemented in key markets including the UK, Germany, and France with the goal of easing traffic congestion and fostering environmentally friendly metropolitan areas.

Competitive Analysis

Recent Development

➣ August 15th, 2023, ParkMobile US and WPS US announced their partnership in order to provide contactless parking payment in gated garage, equipped with WPS equipment across the North America. "As we work toward making cities more livable, we welcome the opportunity to work with other leaders in our industry, like WPS, to create more efficient parking ecosystems. Through the integration of ParkMobile's easy-to-use technology, customers can pay for their parking through our app at gated facilities across the country," said David Hoyt, ParkMobile's Managing Director.

➣ Market 25th, 2024, ParkHub which is a leading North American provider of parking management solutions and payment solutions has announced the agreement to combine business with JustPark, which is amongst U.K’s leading app-based parking reservation technology.

End Use industry analysis

Due to the growing need for effective, user-friendly, and digitally first parking solutions, the cashless parking system market has grown significantly across a number of end-use industries. Shopping malls, office buildings, and entertainment venues prioritize cashless systems to handle large foot traffic and guarantee smooth payment experiences, making the retail and commercial sectors important drivers. These industries have seen a rapid uptake of digital payment systems, satisfying customer demands for ease and assisting in the reduction of traffic and wait times. In order to handle large car numbers and improve the user experience by providing quick, contactless payment alternatives, transportation hubs such as bus terminals, train stations, and airports are also implementing cashless parking systems. Since hospitals and clinics recognize the benefits of cashless parking systems that facilitate patient, employee, and visitor access while promoting safety and hygiene, the healthcare sector is also a sizable market. These solutions lessen the administrative strain of processing cash and enable hospitals to effectively manage parking spaces, particularly during peak hours.

The expansion of smart city initiatives that prioritize digital infrastructure and sustainable urban mobility is anticipated to propel further growth in the residential and municipal sectors. In order to better manage public parking and lessen urban congestion, municipalities are implementing cashless systems, while residential areas are progressively implementing them in gated communities and apartment complexes. The need for cashless parking systems in these end-use industries is anticipated to increase as cities around the world continue to digitize and develop their smart city capabilities. This trend reflects a larger movement towards digital, data-driven urban management solutions.

Industry Dynamics

Industry Driver

Growing demand for convenience and efficiency among consumers

A number of important factors are driving the industry's expansion for cashless parking systems. The growing need for efficiency and convenience among consumers, who choose smooth, contactless payment methods, is one of the main motivators. Users are more likely to use mobile applications for parking transactions as smartphone usage rises globally, allowing for speedy payments without the need for cash or paper tickets. Furthermore, the continuous drive for digital transformation in urban settings is encouraging the incorporation of cashless solutions into smart city projects, which improves parking overall while easing traffic and simplifying operations.

The increased emphasis on public health and safety, especially in the wake of the COVID-19 pandemic, is another important motivator. In order to reduce physical contact and encourage hygiene, many businesses and municipalities are implementing cashless systems, which is in line with consumers' preferences for touchless interactions. Additionally, technological developments like cloud-based software, QR code payments, and license plate recognition are making cashless parking systems easier to use and more accessible, which is speeding up acceptance.

Industry Trend

Growing emphasis on Smart technologies and IoT

A number of noteworthy factors are now influencing the development and use of cashless parking systems in the market. The growing incorporation of smart technology and IoT (Internet of Things) into parking solutions is one notable development. Sensors and smart meters are being installed by numerous cities and private operators to offer real-time data on parking space availability. This enables customers to identify and reserve places using mobile apps. By optimizing space use and improving the user experience, this integration makes parking management more effective.

The emergence of digital wallets and mobile payment platforms as the go-to way for customers to pay for parking is another noteworthy trend. Users are favoring apps that provide contactless purchases, speedy payments, and in-app features like parking expiration warnings as mobile technology develops. In order to satisfy customer requests, this change is forcing parking companies to make investments in and improve their mobile capabilities.

Industry Restraint

Higher Initial Investment

There are a number of barriers that could prevent the cashless parking system market from expanding and becoming widely used. The substantial initial outlay needed for both software and hardware deployment is one major obstacle. The expenses of setting up new infrastructure, such payment kiosks, sensors, and software platforms, may make many governments and business operators hesitant to invest in cashless systems. The adoption of cashless solutions may be slowed down by this cost barrier, especially in smaller cities or less developed areas.

Concerns about cyber security are another barrier. Cashless parking systems are vulnerable to hacks since they mostly rely on digital transactions and data collection. Customers may become less trusting of cashless solutions due to the possibility of data breaches and illegal access to payment information. To safeguard sensitive data, parking companies must make significant investments in security measures, which may raise operating expenses even further.

Furthermore, interoperability problems pose a serious obstacle. It can be difficult to ensure smooth integration and compatibility between diverse technologies given the wide range of parking management systems and payment platforms available. When systems are not standardized, the market may become fragmented and users may find it challenging to switch between different apps and payment options.

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Type, Application. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

|

Attributes |

Details |

|

Segments |

By Type

By Application

|

|

Region Covered |

|

|

Key Market Players |

|

|

Report Coverage |

|

| Report Attributes | Report Details |

|---|---|

| Report Title | Global Cashless Parking System Market Research Report 2024-2030(Status and Outlook) |

| Historical Year | 2018 to 2022 (Data from 2010 can be provided as per availability) |

| Base Year | 2023 |

| Forecast Year | 2031 |

| Number of Pages | 159 Pages |

| Customization Available | Yes, the report can be customized as per your need. |

Frequently Asked Questions ?