Click for best price

Click for best price

Artificial Graphite Market Size, Share 2024

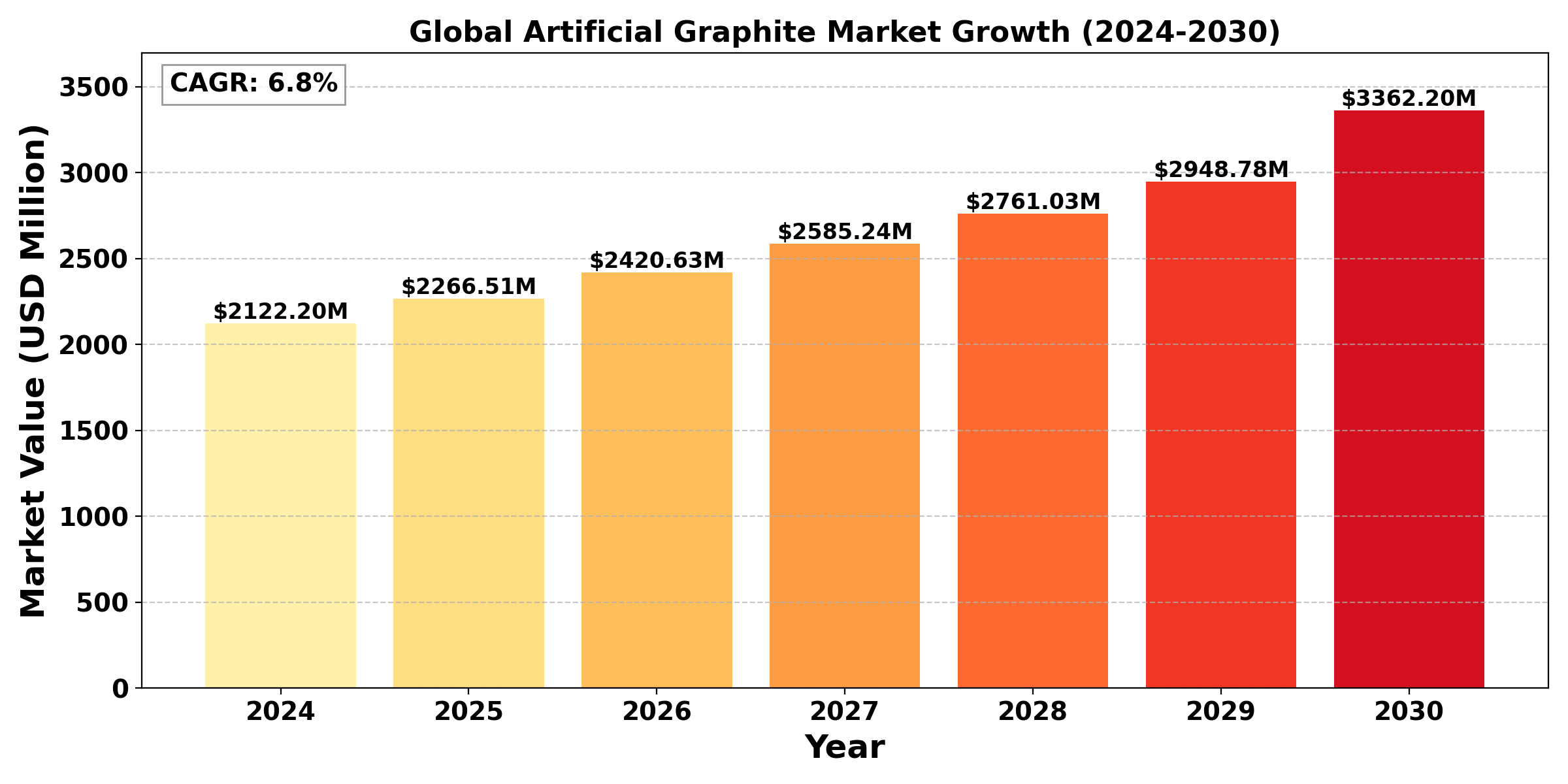

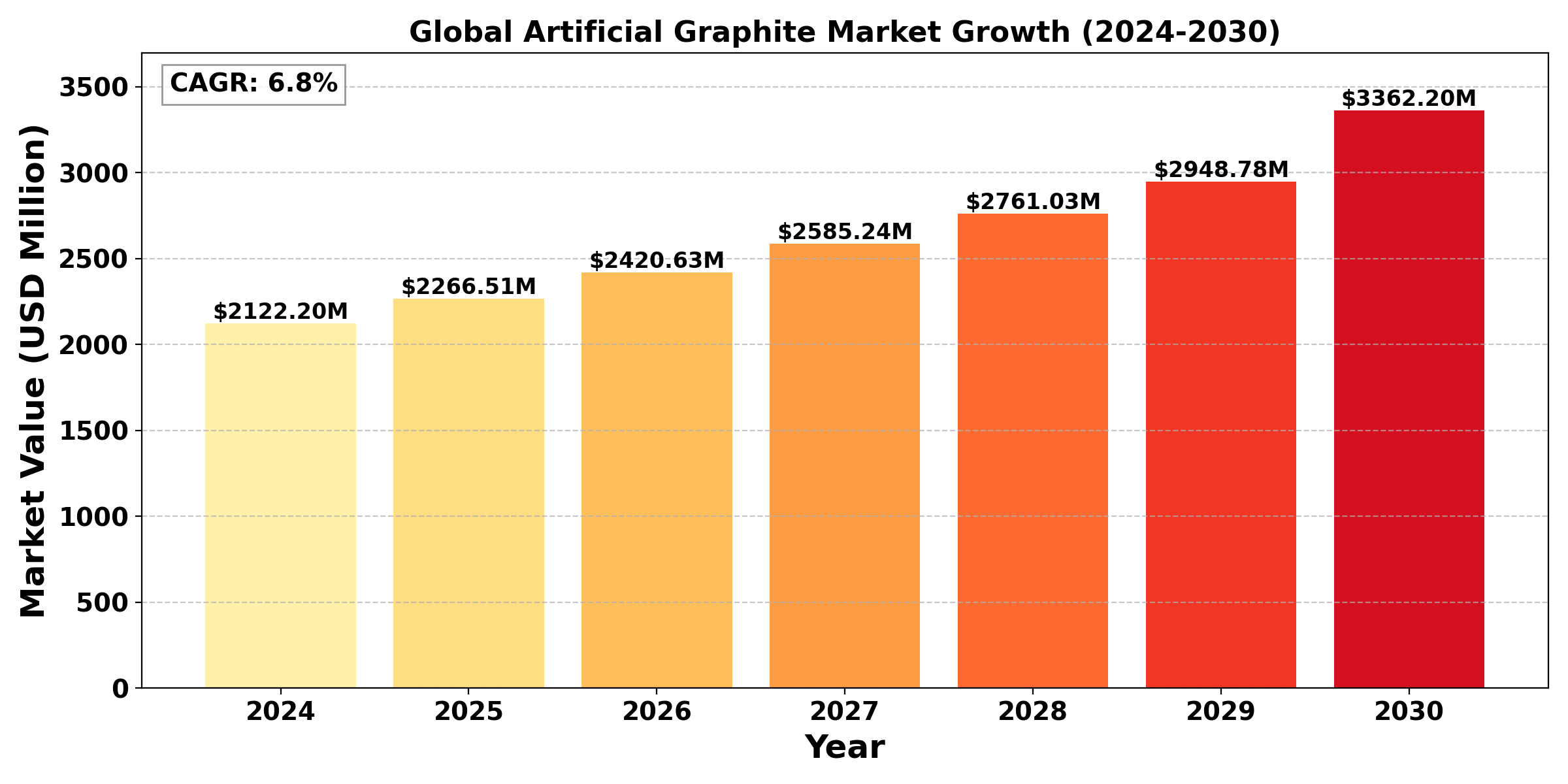

The "Global Artificial Graphite Market" was valued at US$ 2122.2 Million in 2024 and is projected to reach US$ 3362.2 Million by 2030, at a CAGR of 6.8% during the forecast period.

The market for artificial graphite is expanding significantly due to increased demand from industries like metallurgy, electronics, energy storage, and automobiles. High-temperature treatment of carbon-rich materials yields artificial graphite, a man-made form of carbon with superior thermal and electrical conductivity, high-temperature resistance, and chemical stability. As the world's transition to electric vehicles (EVs) accelerates, its uses in lithium-ion batteries are especially significant. The expansion of the EV market has increased investment in battery manufacturing, which has increased demand for artificial graphite because of its use as an anode material. Additionally, artificial graphite is used in the electronics industry for thermal management, which is crucial for controlling heat in high-performance systems. Its effectiveness as a reasonably priced, high-performing electrode material benefits industrial sectors, such as the manufacturing of steel and iron.

Due to strong manufacturing and energy demands, Asia-Pacific dominates the industry, with China as a significant producer and user. Industry use of artificial graphite as a more sustainable substitute for natural graphite is being prompted by environmental laws in North America and Europe. Nonetheless, the market encounters obstacles such as variations in the cost of raw materials and production-related environmental issues. The future direction of the market depends heavily on ongoing research and development in eco-friendly production and recycling techniques.

Segmental Analysis

Artificial graphite to hold the highest market share: By Type

The artificial graphite category has the largest market share in the worldwide artificial graphite market, mostly because of its wide range of applications and excellent performance in vital industries. High-temperature treatment of carbon-rich materials yields artificial graphite, which is prized for its reliable quality, superior electrical and thermal conductivity, and robust resistance to oxidation and corrosion. Because of these qualities, it is the material of choice for producing lithium-ion battery anodes, which are essential for energy storage in renewable energy systems and electric vehicles (EVs). The need for artificial graphite in battery manufacturing has increased due to the global acceleration of the move toward electric vehicles, which has resulted in its domination in the market.

Additionally, artificial graphite is widely utilized as an electrode material in the electronics sector for thermal management solutions in high-performance devices, as well as in the production of steel and iron. Its greater market share is also a result of its advantages over composite artificial graphite, including purity, better performance under high-stress circumstances, and well-established production techniques. Composite artificial graphite is becoming more popular because of its special qualities, although artificial graphite still rules the market because to strong demand from both established and new applications.

Isotropic Graphite to hold the highest market share: By Product Type

In the artificial graphite market, the isotropic graphite segment has the largest market share, mostly because of its distinctive structural features and wide range of high-tech industry applications. Isotropic graphite offers remarkable mechanical strength and thermal conductivity because it is extremely homogeneous in all directions, in contrast to other forms of artificial graphite. Because of its isotropic nature, it is especially well-suited for uses like nuclear reactors, electronics manufacturing, and aircraft that demand great reliability and accurate performance. Isotropic graphite is used in semiconductor manufacturing techniques that need high temperatures and great purity, which are necessary for creating microchips and other electronic components.

Because of its strength, resilience to heat shock, and low weight—all of which are essential for components subjected to extreme conditions and high stress—isotropic graphite is also preferred by the aerospace and defense industries. Because of its consistent performance as an anode material, isotropic graphite is also in high demand due to its application in the manufacturing of lithium-ion batteries. As electronics, electric vehicles, and renewable energy technologies improve, the segment's dominance is anticipated to persist, solidifying isotropic graphite's standing as the material of choice for high-performance applications.

Regional Overview

Asia-Pacific dominates the global market for artificial graphite, especially China, which is the biggest producer and user thanks to its extensive industrial base, strong electronics sector, and expanding electric vehicle (EV) market. The need for artificial graphite, particularly for lithium-ion battery applications, has increased as a result of China's emphasis on developing its EV infrastructure and renewable energy potential. Because of their sophisticated electronics and battery industries, South Korea and Japan are also major players, and India is becoming a more viable market as a result of rising investments in the energy storage and automotive sectors.

Another important region is North America, where demand is driven by the growing use of EVs and cutting-edge energy storage technologies. High-quality artificial graphite is becoming more and more necessary as the United States, in particular, is making significant investments in domestic battery manufacture to lessen reliance on imports. Artificial graphite's uses in electronics, automobiles, and renewable energy are expanding in Europe as a result of strict environmental rules that are forcing companies to use more efficient and sustainable materials.

Increased industrialization and infrastructure development are also propelling the continuous rise of emerging economies in Latin America, the Middle East, and Africa. Global production costs and environmental concerns, however, continue to be obstacles that impact local market conditions and spur innovation in more environmentally friendly production methods.

Competitive Analysis

- Shanshan

- KAITEKI

- BTR

- B&M

- PULEAD

- SINUO

- SHINZOOM

- CHNM

- TOYO TANSO

- Other Key Player

The market for artificial graphite is extremely competitive, with both well-established firms and up-and-coming businesses vying for market share and technological advancements. Due to their wide range of products, global distribution networks, and continuous expenditures in R&D, industry leaders including Tokai Carbon Co., Ltd., GrafTech International, SGL Carbon, Showa Denko K.K., and Nippon Carbon Co., Ltd. hold a significant portion of the market. By establishing themselves as preferred providers for lithium-ion battery anodes and thermal management solutions, these companies are concentrating especially on the rising demand for high-performance materials in the electronics and energy storage industries.

Since highly dependable materials are needed by end-use sectors including automotive, electronics, and aerospace, competition is focused on quality, purity, and customisation capabilities. Smaller and regional businesses are taking advantage of specific applications by providing specialized products and quicker delivery times, while larger competitors use economies of scale to achieve competitive pricing. To solve the environmental issues facing the market, new businesses are also making progress in creating environmentally friendly production techniques and recycling technologies.

Recent Development

July 13, 2023, The U.S. Department of Defense (DoD) has granted USD 37.5 million in technology investment agreement grants to Graphite One Inc.'s wholly owned subsidiary, Graphite One (Alaska), Inc. In order to fulfill the increasing demand for graphite battery anodes for electric vehicles and other energy storage applications, DoD intends to establish the manufacturing capacity and supply of graphite materials through this investment fund.

June 8th 2023, Superior Graphite, a leading producer of graphite, plans to construct

a USD 180 million anode materials facility to meet the accelerating demand for EV’s and

energy storage in the North American and European markets. The company's state- of-the-art Anode Active Material (AAM) enables and accelerates the energy transition. The main facility will be in Hopkinsville, Kentucky, with additional capacity in Sundsvall, Sweden. Superior Graphite's innovative production technology and established operations at these locations result in a continuous production process, significantly reducing capital requirements and operational costs.

End Use Industry Analysis

The artificial graphite market serves a diverse range of end-use industries, with energy storage, automotive, electronics, and metallurgy leading in demand. The energy storage sector, particularly lithium-ion batteries for electric vehicles (EVs) and renewable energy systems, is the primary driver. Artificial graphite is essential as an anode material in batteries due to its high energy density, conductivity, and durability, making it indispensable as EV adoption and energy transition goals accelerate worldwide. The automotive industry’s growth is closely linked to energy storage demand, as automakers increasingly rely on high-performance, long-lasting batteries to enhance EV range and efficiency.

Industry Dynamic

Surge in Electric Vehicle (EV) adoption

The market for artificial graphite is driven by a number of significant industry factors, such as the rise in the use of electric vehicles (EVs), the development of renewable energy storage, improvements in consumer electronics, and expansion in the metallurgical sector. The demand for lithium-ion batteries that use artificial graphite as their primary anode material has increased as a result of the global movement towards electric vehicles and the aggressive carbon reduction objectives set by governments. This demand is further supported by the growing requirement for renewable energy storage technologies, which call for materials with excellent conductivity, durability, and efficiency—all of which artificial graphite possesses.In the electronics sector, rising consumer expectations for high-performance devices like smartphones, laptops, and wearable tech are boosting demand for artificial graphite due to its critical role in thermal management, ensuring that devices remain efficient and safe.

Industry Trend

A number of new trends are emerging in the artificial graphite industry as a result of changing demand dynamics, environmental priorities, and technology breakthroughs. The growing need for high-purity artificial graphite in lithium-ion batteries, particularly for energy storage and electric vehicles (EVs), is one of the most noticeable trends. Battery makers are looking for artificial graphite with improved energy density and durability as EV production expands internationally, which is driving innovation in ultra-high-purity and tailored anode materials.

The market is also being shaped by sustainability initiatives, as businesses look into more environmentally friendly production and recycling techniques to lessen their carbon footprints and address environmental issues. Because it reduces the cost of raw materials and satisfies regulatory demands for environmentally acceptable activities, recycled artificial graphite is becoming more and more popular.

The need for artificial graphite as a heat management solution in small, high-performance devices is further fueled by developments in electronics and 5G infrastructure. Artificial graphite is also gaining popularity in the aerospace and defense industries because of its lightweight and heat-resistant qualities, which make it perfect for high-stress applications. Lastly, as businesses create local supply chains, particularly in Asia-Pacific and North America, to lessen reliance on imports and satisfy rising local demand, regional expansions and strategic alliances are emerging.

Industry Restraint

Volatile Price of Raw Materials

One significant restraint in the artificial graphite market is the volatility in raw material prices, particularly for petroleum-based feedstocks, which are crucial in the production of artificial graphite. The fluctuating prices of crude oil and the availability of high-quality carbon materials can significantly impact production costs, leading to unpredictable pricing for end products. This volatility creates challenges for manufacturers in maintaining profit margins and can deter investment in capacity expansion or technological advancements. Additionally, such price instability may push some companies to consider alternative materials, which could further threaten market growth. As industries increasingly seek cost-effective and sustainable solutions, navigating these fluctuations while ensuring consistent quality will be crucial for stakeholders in the artificial graphite market.

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Type, Application, Product Type, End Use Industry, The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

|

Attributes

|

Details

|

|

Segments

|

By Type

- Artificial graphite

- Composite Artificial Graphite

By Application

- Refractory material

- Metallurgy

- Spare parts

- Battery

By Product Type

- Isotropic Graphite

- Extruded Graphite

- Molded Graphite

- Other Types (e.g., Graphitized Petroleum Coke)

By End Use Industry

- Automotive

- Energy

- Metallurgy

- Electronics

- Others

|

|

Region Covered

|

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South Africa

|

|

Key Market Players

|

- Shanshan

- KAITEKI

- BTR

- B&M

- PULEAD

- SINUO

- SHINZOOM

- CHNM

- TOYO TANSO

- Other Key Players

|

|

Report Coverage

|

- Industry Trends

- SWOT Analysis

- PESTEL Analysis

- Porter’s Five Forces Analysis

- Market Competition by Manufacturers

- Key Companies Profiled

- Marketing Channel, Distributors and Customers

- Market Dynamics

- Production and Supply Forecast

- Demand Forecast

- Research Findings and Conclusion

|

| Report Attributes |

Report Details |

| Report Title |

Artificial Graphite Market, Global Outlook and Forecast 2024-2030 |

| Historical Year |

2018 to 2022 (Data from 2010 can be provided as per availability) |

| Base Year |

2023 |

| Forecast Year |

2031 |

| Number of Pages |

102 Pages |

| Customization Available |

Yes, the report can be customized as per your need. |

TABLE OF CONTENTS

1 Introduction to Research & Analysis Reports

1.1 Artificial Graphite Market Definition

1.2 Market Segments

1.2.1 Market by Type

1.2.2 Market by Application

1.3 Global Artificial Graphite Market Overview

1.4 Features & Benefits of This Report

1.5 Methodology & Sources of Information

1.5.1 Research Methodology

1.5.2 Research Process

1.5.3 Base Year

1.5.4 Report Assumptions & Caveats

2 Global Artificial Graphite Overall Market Size

2.1 Global Artificial Graphite Market Size: 2023 VS 2030

2.2 Global Artificial Graphite Revenue, Prospects & Forecasts: 2019-2030

2.3 Global Artificial Graphite Sales: 2019-2030

3 Company Landscape

3.1 Top Artificial Graphite Players in Global Market

3.2 Top Global Artificial Graphite Companies Ranked by Revenue

3.3 Global Artificial Graphite Revenue by Companies

3.4 Global Artificial Graphite Sales by Companies

3.5 Global Artificial Graphite Price by Manufacturer (2019-2024)

3.6 Top 3 and Top 5 Artificial Graphite Companies in Global Market, by Revenue in 2023

3.7 Global Manufacturers Artificial Graphite Product Type

3.8 Tier 1, Tier 2 and Tier 3 Artificial Graphite Players in Global Market

3.8.1 List of Global Tier 1 Artificial Graphite Companies

3.8.2 List of Global Tier 2 and Tier 3 Artificial Graphite Companies

4 Sights by Product

4.1 Overview

4.1.1 By Type - Global Artificial Graphite Market Size Markets, 2023 & 2030

4.1.2 Artificial graphite

4.1.3 Composite Artificial Graphite

4.2 By Type - Global Artificial Graphite Revenue & Forecasts

4.2.1 By Type - Global Artificial Graphite Revenue, 2019-2024

4.2.2 By Type - Global Artificial Graphite Revenue, 2025-2030

4.2.3 By Type - Global Artificial Graphite Revenue Market Share, 2019-2030

4.3 By Type - Global Artificial Graphite Sales & Forecasts

4.3.1 By Type - Global Artificial Graphite Sales, 2019-2024

4.3.2 By Type - Global Artificial Graphite Sales, 2025-2030

4.3.3 By Type - Global Artificial Graphite Sales Market Share, 2019-2030

4.4 By Type - Global Artificial Graphite Price (Manufacturers Selling Prices), 2019-2030

5 Sights by Application

5.1 Overview

5.1.1 By Application - Global Artificial Graphite Market Size, 2023 & 2030

5.1.2 Refractory material

5.1.3 Metallurgy

5.1.4 Spare parts

5.1.5 Battery

5.2 By Application - Global Artificial Graphite Revenue & Forecasts

5.2.1 By Application - Global Artificial Graphite Revenue, 2019-2024

5.2.2 By Application - Global Artificial Graphite Revenue, 2025-2030

5.2.3 By Application - Global Artificial Graphite Revenue Market Share, 2019-2030

5.3 By Application - Global Artificial Graphite Sales & Forecasts

5.3.1 By Application - Global Artificial Graphite Sales, 2019-2024

5.3.2 By Application - Global Artificial Graphite Sales, 2025-2030

5.3.3 By Application - Global Artificial Graphite Sales Market Share, 2019-2030

5.4 By Application - Global Artificial Graphite Price (Manufacturers Selling Prices), 2019-2030

6 Sights by Region

6.1 By Region - Global Artificial Graphite Market Size, 2023 & 2030

6.2 By Region - Global Artificial Graphite Revenue & Forecasts

6.2.1 By Region - Global Artificial Graphite Revenue, 2019-2024

6.2.2 By Region - Global Artificial Graphite Revenue, 2025-2030

6.2.3 By Region - Global Artificial Graphite Revenue Market Share, 2019-2030

6.3 By Region - Global Artificial Graphite Sales & Forecasts

6.3.1 By Region - Global Artificial Graphite Sales, 2019-2024

6.3.2 By Region - Global Artificial Graphite Sales, 2025-2030

6.3.3 By Region - Global Artificial Graphite Sales Market Share, 2019-2030

6.4 North America

6.4.1 By Country - North America Artificial Graphite Revenue, 2019-2030

6.4.2 By Country - North America Artificial Graphite Sales, 2019-2030

6.4.3 US Artificial Graphite Market Size, 2019-2030

6.4.4 Canada Artificial Graphite Market Size, 2019-2030

6.4.5 Mexico Artificial Graphite Market Size, 2019-2030

6.5 Europe

6.5.1 By Country - Europe Artificial Graphite Revenue, 2019-2030

6.5.2 By Country - Europe Artificial Graphite Sales, 2019-2030

6.5.3 Germany Artificial Graphite Market Size, 2019-2030

6.5.4 France Artificial Graphite Market Size, 2019-2030

6.5.5 U.K. Artificial Graphite Market Size, 2019-2030

6.5.6 Italy Artificial Graphite Market Size, 2019-2030

6.5.7 Russia Artificial Graphite Market Size, 2019-2030

6.5.8 Nordic Countries Artificial Graphite Market Size, 2019-2030

6.5.9 Benelux Artificial Graphite Market Size, 2019-2030

6.6 Asia

6.6.1 By Region - Asia Artificial Graphite Revenue, 2019-2030

6.6.2 By Region - Asia Artificial Graphite Sales, 2019-2030

6.6.3 China Artificial Graphite Market Size, 2019-2030

6.6.4 Japan Artificial Graphite Market Size, 2019-2030

6.6.5 South Korea Artificial Graphite Market Size, 2019-2030

6.6.6 Southeast Asia Artificial Graphite Market Size, 2019-2030

6.6.7 India Artificial Graphite Market Size, 2019-2030

6.7 South America

6.7.1 By Country - South America Artificial Graphite Revenue, 2019-2030

6.7.2 By Country - South America Artificial Graphite Sales, 2019-2030

6.7.3 Brazil Artificial Graphite Market Size, 2019-2030

6.7.4 Argentina Artificial Graphite Market Size, 2019-2030

6.8 Middle East & Africa

6.8.1 By Country - Middle East & Africa Artificial Graphite Revenue, 2019-2030

6.8.2 By Country - Middle East & Africa Artificial Graphite Sales, 2019-2030

6.8.3 Turkey Artificial Graphite Market Size, 2019-2030

6.8.4 Israel Artificial Graphite Market Size, 2019-2030

6.8.5 Saudi Arabia Artificial Graphite Market Size, 2019-2030

6.8.6 UAE Artificial Graphite Market Size, 2019-2030

7 Manufacturers & Brands Profiles

7.1 Shanshan

7.1.1 Shanshan Company Summary

7.1.2 Shanshan Business Overview

7.1.3 Shanshan Artificial Graphite Major Product Offerings

7.1.4 Shanshan Artificial Graphite Sales and Revenue in Global (2019-2024)

7.1.5 Shanshan Key News & Latest Developments

7.2 KAITEKI

7.2.1 KAITEKI Company Summary

7.2.2 KAITEKI Business Overview

7.2.3 KAITEKI Artificial Graphite Major Product Offerings

7.2.4 KAITEKI Artificial Graphite Sales and Revenue in Global (2019-2024)

7.2.5 KAITEKI Key News & Latest Developments

7.3 BTR

7.3.1 BTR Company Summary

7.3.2 BTR Business Overview

7.3.3 BTR Artificial Graphite Major Product Offerings

7.3.4 BTR Artificial Graphite Sales and Revenue in Global (2019-2024)

7.3.5 BTR Key News & Latest Developments

7.4 B&M

7.4.1 B&M Company Summary

7.4.2 B&M Business Overview

7.4.3 B&M Artificial Graphite Major Product Offerings

7.4.4 B&M Artificial Graphite Sales and Revenue in Global (2019-2024)

7.4.5 B&M Key News & Latest Developments

7.5 PULEAD

7.5.1 PULEAD Company Summary

7.5.2 PULEAD Business Overview

7.5.3 PULEAD Artificial Graphite Major Product Offerings

7.5.4 PULEAD Artificial Graphite Sales and Revenue in Global (2019-2024)

7.5.5 PULEAD Key News & Latest Developments

7.6 SINUO

7.6.1 SINUO Company Summary

7.6.2 SINUO Business Overview

7.6.3 SINUO Artificial Graphite Major Product Offerings

7.6.4 SINUO Artificial Graphite Sales and Revenue in Global (2019-2024)

7.6.5 SINUO Key News & Latest Developments

7.7 SHINZOOM

7.7.1 SHINZOOM Company Summary

7.7.2 SHINZOOM Business Overview

7.7.3 SHINZOOM Artificial Graphite Major Product Offerings

7.7.4 SHINZOOM Artificial Graphite Sales and Revenue in Global (2019-2024)

7.7.5 SHINZOOM Key News & Latest Developments

7.8 CHNM

7.8.1 CHNM Company Summary

7.8.2 CHNM Business Overview

7.8.3 CHNM Artificial Graphite Major Product Offerings

7.8.4 CHNM Artificial Graphite Sales and Revenue in Global (2019-2024)

7.8.5 CHNM Key News & Latest Developments

7.9 TOYO TANSO

7.9.1 TOYO TANSO Company Summary

7.9.2 TOYO TANSO Business Overview

7.9.3 TOYO TANSO Artificial Graphite Major Product Offerings

7.9.4 TOYO TANSO Artificial Graphite Sales and Revenue in Global (2019-2024)

7.9.5 TOYO TANSO Key News & Latest Developments

8 Global Artificial Graphite Production Capacity, Analysis

8.1 Global Artificial Graphite Production Capacity, 2019-2030

8.2 Artificial Graphite Production Capacity of Key Manufacturers in Global Market

8.3 Global Artificial Graphite Production by Region

9 Key Market Trends, Opportunity, Drivers and Restraints

9.1 Market Opportunities & Trends

9.2 Market Drivers

9.3 Market Restraints

10 Artificial Graphite Supply Chain Analysis

10.1 Artificial Graphite Industry Value Chain

10.2 Artificial Graphite Upstream Market

10.3 Artificial Graphite Downstream and Clients

10.4 Marketing Channels Analysis

10.4.1 Marketing Channels

10.4.2 Artificial Graphite Distributors and Sales Agents in Global

11 Conclusion

12 Appendix

12.1 Note

12.2 Examples of Clients

12.3 Disclaimer

LIST OF TABLES & FIGURES

List of Tables

Table 1. Key Players of Artificial Graphite in Global Market

Table 2. Top Artificial Graphite Players in Global Market, Ranking by Revenue (2023)

Table 3. Global Artificial Graphite Revenue by Companies, (US$, Mn), 2019-2024

Table 4. Global Artificial Graphite Revenue Share by Companies, 2019-2024

Table 5. Global Artificial Graphite Sales by Companies, (K MT), 2019-2024

Table 6. Global Artificial Graphite Sales Share by Companies, 2019-2024

Table 7. Key Manufacturers Artificial Graphite Price (2019-2024) & (USD/MT)

Table 8. Global Manufacturers Artificial Graphite Product Type

Table 9. List of Global Tier 1 Artificial Graphite Companies, Revenue (US$, Mn) in 2023 and Market Share

Table 10. List of Global Tier 2 and Tier 3 Artificial Graphite Companies, Revenue (US$, Mn) in 2023 and Market Share

Table 11. By Type ? Global Artificial Graphite Revenue, (US$, Mn), 2023 & 2030

Table 12. By Type - Global Artificial Graphite Revenue (US$, Mn), 2019-2024

Table 13. By Type - Global Artificial Graphite Revenue (US$, Mn), 2025-2030

Table 14. By Type - Global Artificial Graphite Sales (K MT), 2019-2024

Table 15. By Type - Global Artificial Graphite Sales (K MT), 2025-2030

Table 16. By Application ? Global Artificial Graphite Revenue, (US$, Mn), 2023 & 2030

Table 17. By Application - Global Artificial Graphite Revenue (US$, Mn), 2019-2024

Table 18. By Application - Global Artificial Graphite Revenue (US$, Mn), 2025-2030

Table 19. By Application - Global Artificial Graphite Sales (K MT), 2019-2024

Table 20. By Application - Global Artificial Graphite Sales (K MT), 2025-2030

Table 21. By Region ? Global Artificial Graphite Revenue, (US$, Mn), 2023 VS 2030

Table 22. By Region - Global Artificial Graphite Revenue (US$, Mn), 2019-2024

Table 23. By Region - Global Artificial Graphite Revenue (US$, Mn), 2025-2030

Table 24. By Region - Global Artificial Graphite Sales (K MT), 2019-2024

Table 25. By Region - Global Artificial Graphite Sales (K MT), 2025-2030

Table 26. By Country - North America Artificial Graphite Revenue, (US$, Mn), 2019-2024

Table 27. By Country - North America Artificial Graphite Revenue, (US$, Mn), 2025-2030

Table 28. By Country - North America Artificial Graphite Sales, (K MT), 2019-2024

Table 29. By Country - North America Artificial Graphite Sales, (K MT), 2025-2030

Table 30. By Country - Europe Artificial Graphite Revenue, (US$, Mn), 2019-2024

Table 31. By Country - Europe Artificial Graphite Revenue, (US$, Mn), 2025-2030

Table 32. By Country - Europe Artificial Graphite Sales, (K MT), 2019-2024

Table 33. By Country - Europe Artificial Graphite Sales, (K MT), 2025-2030

Table 34. By Region - Asia Artificial Graphite Revenue, (US$, Mn), 2019-2024

Table 35. By Region - Asia Artificial Graphite Revenue, (US$, Mn), 2025-2030

Table 36. By Region - Asia Artificial Graphite Sales, (K MT), 2019-2024

Table 37. By Region - Asia Artificial Graphite Sales, (K MT), 2025-2030

Table 38. By Country - South America Artificial Graphite Revenue, (US$, Mn), 2019-2024

Table 39. By Country - South America Artificial Graphite Revenue, (US$, Mn), 2025-2030

Table 40. By Country - South America Artificial Graphite Sales, (K MT), 2019-2024

Table 41. By Country - South America Artificial Graphite Sales, (K MT), 2025-2030

Table 42. By Country - Middle East & Africa Artificial Graphite Revenue, (US$, Mn), 2019-2024

Table 43. By Country - Middle East & Africa Artificial Graphite Revenue, (US$, Mn), 2025-2030

Table 44. By Country - Middle East & Africa Artificial Graphite Sales, (K MT), 2019-2024

Table 45. By Country - Middle East & Africa Artificial Graphite Sales, (K MT), 2025-2030

Table 46. Shanshan Company Summary

Table 47. Shanshan Artificial Graphite Product Offerings

Table 48. Shanshan Artificial Graphite Sales (K MT), Revenue (US$, Mn) and Average Price (USD/MT) (2019-2024)

Table 49. Shanshan Key News & Latest Developments

Table 50. KAITEKI Company Summary

Table 51. KAITEKI Artificial Graphite Product Offerings

Table 52. KAITEKI Artificial Graphite Sales (K MT), Revenue (US$, Mn) and Average Price (USD/MT) (2019-2024)

Table 53. KAITEKI Key News & Latest Developments

Table 54. BTR Company Summary

Table 55. BTR Artificial Graphite Product Offerings

Table 56. BTR Artificial Graphite Sales (K MT), Revenue (US$, Mn) and Average Price (USD/MT) (2019-2024)

Table 57. BTR Key News & Latest Developments

Table 58. B&M Company Summary

Table 59. B&M Artificial Graphite Product Offerings

Table 60. B&M Artificial Graphite Sales (K MT), Revenue (US$, Mn) and Average Price (USD/MT) (2019-2024)

Table 61. B&M Key News & Latest Developments

Table 62. PULEAD Company Summary

Table 63. PULEAD Artificial Graphite Product Offerings

Table 64. PULEAD Artificial Graphite Sales (K MT), Revenue (US$, Mn) and Average Price (USD/MT) (2019-2024)

Table 65. PULEAD Key News & Latest Developments

Table 66. SINUO Company Summary

Table 67. SINUO Artificial Graphite Product Offerings

Table 68. SINUO Artificial Graphite Sales (K MT), Revenue (US$, Mn) and Average Price (USD/MT) (2019-2024)

Table 69. SINUO Key News & Latest Developments

Table 70. SHINZOOM Company Summary

Table 71. SHINZOOM Artificial Graphite Product Offerings

Table 72. SHINZOOM Artificial Graphite Sales (K MT), Revenue (US$, Mn) and Average Price (USD/MT) (2019-2024)

Table 73. SHINZOOM Key News & Latest Developments

Table 74. CHNM Company Summary

Table 75. CHNM Artificial Graphite Product Offerings

Table 76. CHNM Artificial Graphite Sales (K MT), Revenue (US$, Mn) and Average Price (USD/MT) (2019-2024)

Table 77. CHNM Key News & Latest Developments

Table 78. TOYO TANSO Company Summary

Table 79. TOYO TANSO Artificial Graphite Product Offerings

Table 80. TOYO TANSO Artificial Graphite Sales (K MT), Revenue (US$, Mn) and Average Price (USD/MT) (2019-2024)

Table 81. TOYO TANSO Key News & Latest Developments

Table 82. Artificial Graphite Production Capacity (K MT) of Key Manufacturers in Global Market, 2022-2024 (K MT)

Table 83. Global Artificial Graphite Capacity Market Share of Key Manufacturers, 2022-2024

Table 84. Global Artificial Graphite Production by Region, 2019-2024 (K MT)

Table 85. Global Artificial Graphite Production by Region, 2025-2030 (K MT)

Table 86. Artificial Graphite Market Opportunities & Trends in Global Market

Table 87. Artificial Graphite Market Drivers in Global Market

Table 88. Artificial Graphite Market Restraints in Global Market

Table 89. Artificial Graphite Raw Materials

Table 90. Artificial Graphite Raw Materials Suppliers in Global Market

Table 91. Typical Artificial Graphite Downstream

Table 92. Artificial Graphite Downstream Clients in Global Market

Table 93. Artificial Graphite Distributors and Sales Agents in Global Market

List of Figures

Figure 1. Artificial Graphite Segment by Type in 2023

Figure 2. Artificial Graphite Segment by Application in 2023

Figure 3. Global Artificial Graphite Market Overview: 2023

Figure 4. Key Caveats

Figure 5. Global Artificial Graphite Market Size: 2023 VS 2030 (US$, Mn)

Figure 6. Global Artificial Graphite Revenue, 2019-2030 (US$, Mn)

Figure 7. Artificial Graphite Sales in Global Market: 2019-2030 (K MT)

Figure 8. The Top 3 and 5 Players Market Share by Artificial Graphite Revenue in 2023

Figure 9. By Type - Global Artificial Graphite Revenue, (US$, Mn), 2023 & 2030

Figure 10. By Type - Global Artificial Graphite Revenue Market Share, 2019-2030

Figure 11. By Type - Global Artificial Graphite Sales Market Share, 2019-2030

Figure 12. By Type - Global Artificial Graphite Price (USD/MT), 2019-2030

Figure 13. By Application - Global Artificial Graphite Revenue, (US$, Mn), 2023 & 2030

Figure 14. By Application - Global Artificial Graphite Revenue Market Share, 2019-2030

Figure 15. By Application - Global Artificial Graphite Sales Market Share, 2019-2030

Figure 16. By Application - Global Artificial Graphite Price (USD/MT), 2019-2030

Figure 17. By Region - Global Artificial Graphite Revenue, (US$, Mn), 2023 & 2030

Figure 18. By Region - Global Artificial Graphite Revenue Market Share, 2019 VS 2023 VS 2030

Figure 19. By Region - Global Artificial Graphite Revenue Market Share, 2019-2030

Figure 20. By Region - Global Artificial Graphite Sales Market Share, 2019-2030

Figure 21. By Country - North America Artificial Graphite Revenue Market Share, 2019-2030

Figure 22. By Country - North America Artificial Graphite Sales Market Share, 2019-2030

Figure 23. US Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 24. Canada Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 25. Mexico Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 26. By Country - Europe Artificial Graphite Revenue Market Share, 2019-2030

Figure 27. By Country - Europe Artificial Graphite Sales Market Share, 2019-2030

Figure 28. Germany Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 29. France Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 30. U.K. Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 31. Italy Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 32. Russia Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 33. Nordic Countries Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 34. Benelux Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 35. By Region - Asia Artificial Graphite Revenue Market Share, 2019-2030

Figure 36. By Region - Asia Artificial Graphite Sales Market Share, 2019-2030

Figure 37. China Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 38. Japan Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 39. South Korea Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 40. Southeast Asia Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 41. India Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 42. By Country - South America Artificial Graphite Revenue Market Share, 2019-2030

Figure 43. By Country - South America Artificial Graphite Sales Market Share, 2019-2030

Figure 44. Brazil Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 45. Argentina Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 46. By Country - Middle East & Africa Artificial Graphite Revenue Market Share, 2019-2030

Figure 47. By Country - Middle East & Africa Artificial Graphite Sales Market Share, 2019-2030

Figure 48. Turkey Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 49. Israel Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 50. Saudi Arabia Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 51. UAE Artificial Graphite Revenue, (US$, Mn), 2019-2030

Figure 52. Global Artificial Graphite Production Capacity (K MT), 2019-2030

Figure 53. The Percentage of Production Artificial Graphite by Region, 2023 VS 2030

Figure 54. Artificial Graphite Industry Value Chain

Figure 55. Marketing Channels

Click for best price

Click for best price