Click for best price

Click for best price

Adenosine Market Size, Share 2024

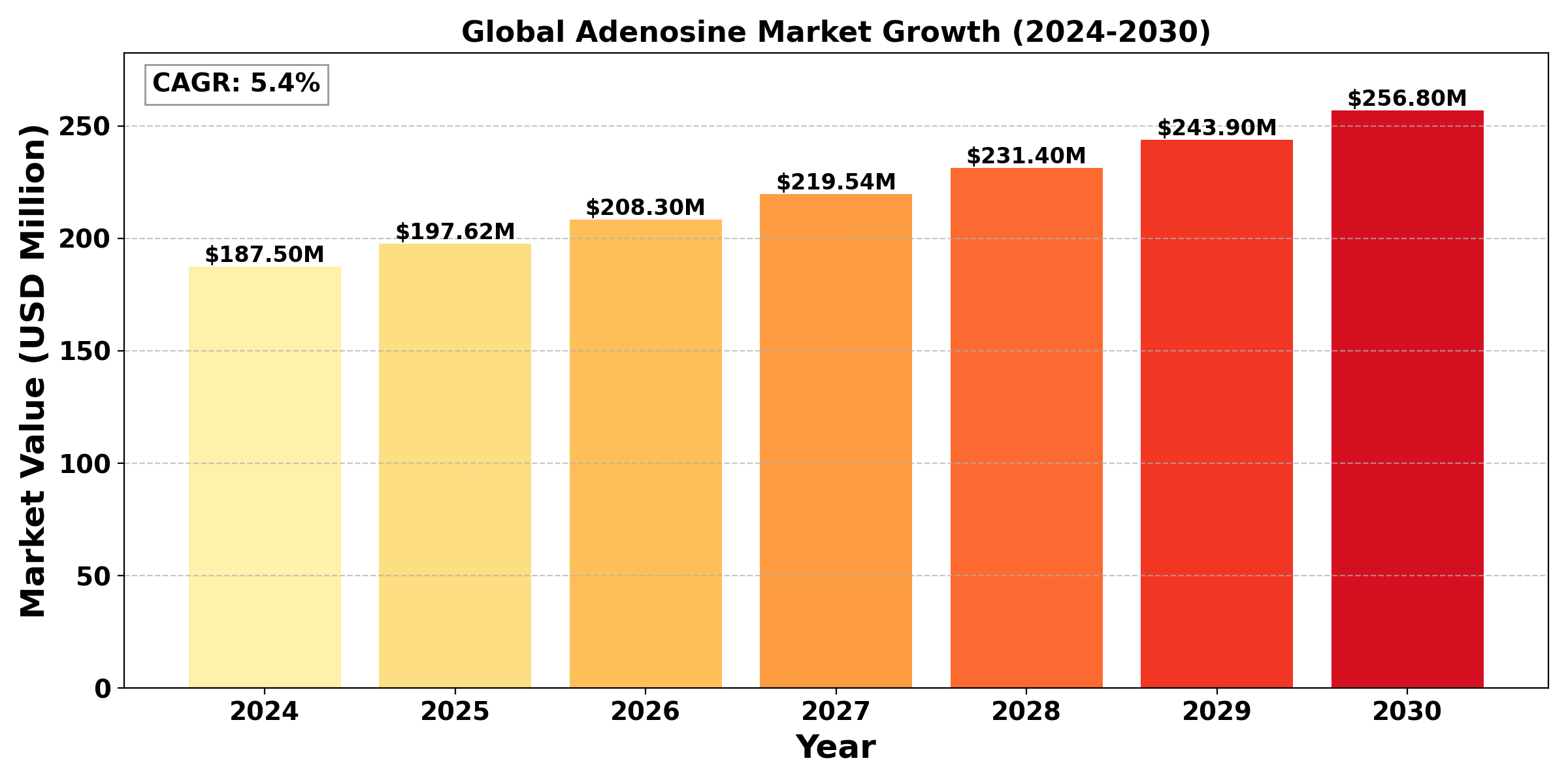

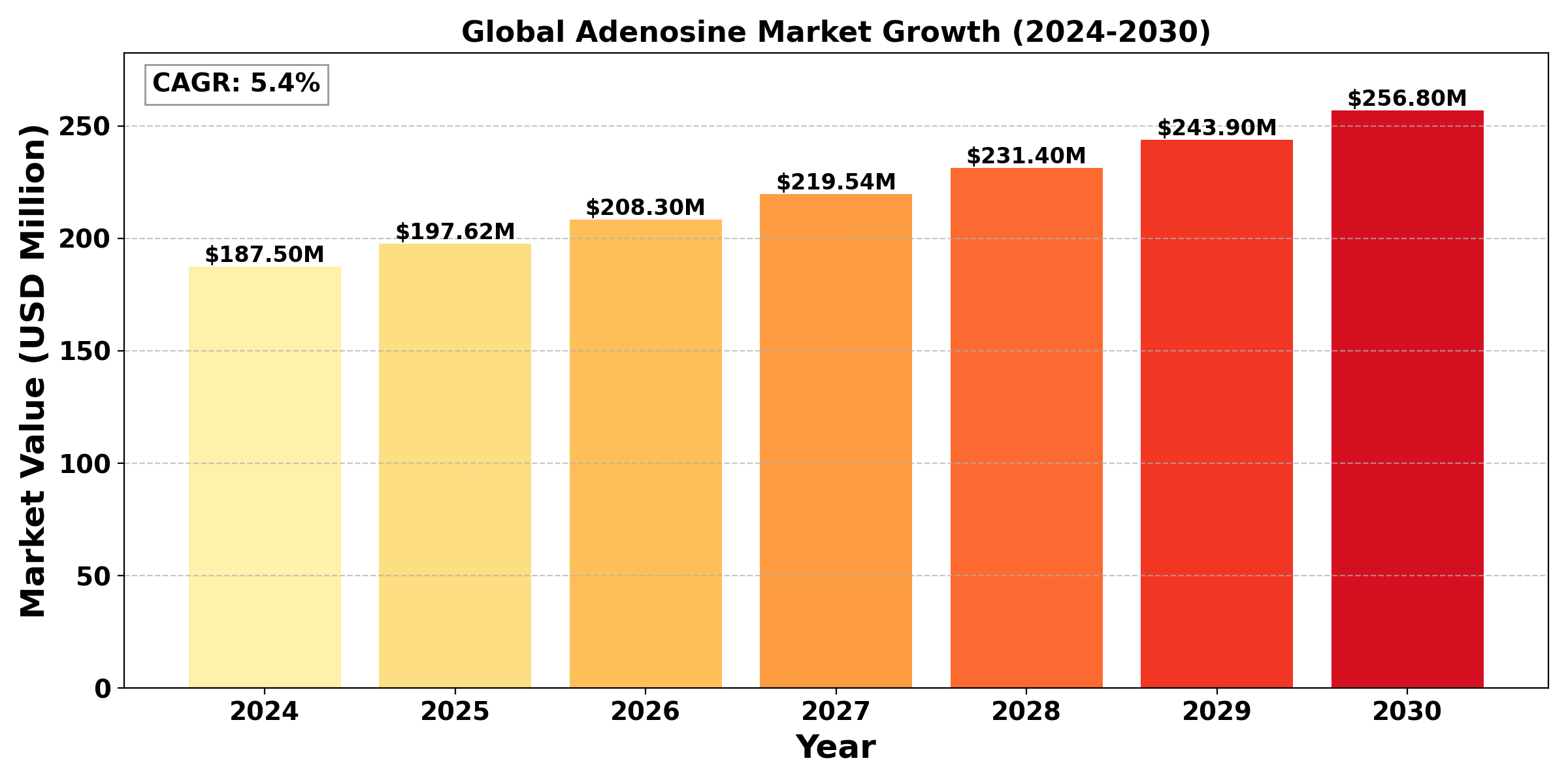

| Market size in 2024 |

US$ 187.5 million

|

Forecast Market size by 2030 |

US$ 256.8 million

|

| Growth Rate |

CAGR of 5.4% |

Number of Pages |

94 Pages |

Industry Overview

The "Global Adenosine Market" size was valued at US$ 187.5 million in 2024 and is projected to reach US$ 256.8 million by 2030, at a CAGR of 5.4% during the forecast period 2024-2030.

The market for adenosine is expanding significantly on a global scale due to its numerous uses in a variety of sectors, especially biotechnology and pharmaceuticals. Adenosine, a nucleoside made up of adenine and ribose, is essential for signalling and cellular energy transfer. One of its medicinal uses is the treatment of cardiac arrhythmias, where it is employed as an antiarrhythmic drug to return the heart to a normal rhythm. Adenosine's market potential is further increased by research into its possible therapeutic effects in the treatment of cancer, neurological problems, and as an immune and inflammatory regulator.

The demand for adenosine-based treatments is being driven by the rising geriatric population and the increasing prevalence of cardiovascular illnesses. Furthermore, new adenosine receptor agonists and improvements in drug formulation technology are opening up new commercial potential. Geographically, North America dominates because of its established healthcare system and substantial investments in R&D, but the Asia-Pacific area is expected to grow rapidly due to rising healthcare costs and growing awareness of cutting-edge treatments. The industry is expected to grow rapidly as research into new uses for adenosine continues, drawing in investment and creativity from a variety of industries.

Segmental Analysis

Above 99% to hold the highest market share: By Type

99% adenosine has the largest market share in the worldwide adenosine market, mostly because of its wide range of uses in the pharmaceutical industry. For medicinal applications, this high-purity form of adenosine is essential, especially for treating cardiac arrhythmias. Its significance in critical care is highlighted by the fact that 99% adenosine is used as an antiarrhythmic medication in emergency medical settings to restore normal heart rhythm. The market dominance of 99% adenosine is further cemented by the strict regulatory requirements for pharmaceutical goods, which need high purity to guarantee both efficacy and patient safety.

Apart from its use in cardiology, 99% adenosine is being researched for a number of therapeutic uses, such as the treatment of cancer, inflammatory diseases, and neurological problems. Demand is being driven by this continuous research and the creation of innovative formulations, which is why 99% adenosine is a top priority for both researchers and pharmaceutical businesses.

On the other hand, although still relevant, 98% adenosine is usually used in less important contexts, such research and lab settings, where the utmost purity requirement is not as strict. Because of this, 98% adenosine ends up gaining a smaller market share. Adenosine's higher share of the market of 99% is a result of its vital function in healthcare, the rise in cardiovascular illness, and the increased emphasis on premium pharmaceutical ingredients. With continued advancements perhaps broadening its uses, 99% adenosine is anticipated to hold its dominant position in the global adenosine market as the need for safe and efficient treatment alternatives increases.

Adenosine Triphosphate (ATP) holds the highest market share: By Application

Among the several applications, adenosine triphosphate (ATP) has the largest market share in the global adenosine market. As the main source of energy in all living cells, ATP is a crucial molecule that is required for many biochemical functions, such as muscular contraction, neurotransmission, and cellular respiration. Its vital function in metabolism and energy transfer fuels demand across a number of industries, most notably in research, biotechnology, and medicines. ATP's market popularity is being further enhanced by the pharmaceutical industry's growing exploration of its potential therapeutic applications in treating ailments like neurological disorders, metabolic dysfunctions, and cardiovascular diseases.

Adenine, which is mostly used in the manufacturing of biopharmaceuticals and as a building block in the synthesis of DNA and RNA, is another important use of adenosine after ATP. However, because of its more specialized use, its market share is relatively lower than that of ATP. The "other" category covers a variety of specialized uses, such as research reagents and food and beverage additives, although they fall short of the scope and diversity of ATP's uses.

In addition to its basic biological significance, ATP's dominance in the adenosine market is a reflection of the increased interest in its medicinal potential, which is fuelling research and development. It is anticipated that ATP's market share would increase further as more people become aware of its advantages, helped along by continuous developments in biotechnology and medical research.

Regional Analysis

The global adenosine market exhibits distinct regional dynamics influenced by factors such as healthcare infrastructure, research and development activities, and regulatory environments. Due to its sophisticated healthcare system and large investments in pharmaceutical research, North America holds a significant share of the market. One important factor is the region's thriving biotechnology industry, where many businesses are working to provide cutting-edge adenosine-based treatments. Furthermore, established regulatory frameworks make it easier to introduce new items, which further contributes to the region's dominance.

The healthcare infrastructure, R&D activities, and regulatory frameworks are some of the elements that impact the global adenosine market's unique regional characteristics. Due to its sophisticated healthcare system and large investments in pharmaceutical research, North America holds a significant share of the market. One important factor is the region's thriving biotechnology industry, where many businesses are working to provide cutting-edge adenosine-based treatments. Furthermore, established regulatory frameworks make it easier to introduce new items, which further contributes to the region's dominance.

The adenosine market in the Asia-Pacific area is expanding quickly due to factors such growing medical expenses, an aging population, and increased awareness of cutting-edge treatments. With growing pharmaceutical industries and a growing need for cutting-edge healthcare solutions, nations like China and India are becoming major players. It is anticipated that the growing number of research institutes and industry-academia collaboration projects in this area will improve the manufacturing and marketing of adenosine-based products.

Competitive Landscape

- Meihua Group

- Yamasa

- Tuoxin

- Mingxin Pharmaceutical

- Nantong Sane Biological

- Other Key Players

End Use Industry Analysis

The global adenosine market's end-use industry study shows a varied landscape, dominated by the biotechnology and pharmaceutical industries. With a major share of the global demand, the pharmaceutical sector is the biggest end user of adenosine. Within this field, adenosine is frequently used as an effective antiarrhythmic medication to treat cardiac arrhythmias. As new benefits are discovered by study, its prospective uses in a variety of therapeutic areas, such as neurology, oncology, and inflammation, are growing, making it more relevant in the creation of new drugs.

Adenosine is used in a number of biotechnological procedures, such as the creation of recombinant proteins and vaccinations, making the biotechnology industry a significant end user in addition to medicines. Adenosine is essential for promoting cell development and improving metabolic processes in tissue engineering and cell culture. The need for adenosine in research and development applications is anticipated to rise further as the biotechnology sector expands due to developments in genetic engineering and personalized medicine.

Additionally, adenosine is increasingly being used by the food and beverage sector as an end user, especially when it comes to food additives and supplements. Because of its possible health advantages, such as improved energy metabolism and cognitive function, adenosine is increasingly being used in functional foods and nutritional supplements.

Industry Dynamics

Industry Driver

Increasing incidence of Cardiovascular Diseases

The growing prevalence of cardiovascular illnesses, which has raised the need for efficient treatment choices, is one of the major factors propelling the global adenosine market. Healthcare professionals are under pressure to provide effective therapies for individuals with disorders like cardiac arrhythmias since lifestyle factors including poor diet, inactivity, and elevated stress levels increase the occurrence of heart-related conditions. In emergency and acute care settings, where prompt management is crucial for patient outcomes, adenosine has emerged as a crucial intervention due to its quick action in restoring normal heart rhythm.

The need for adenosine-based treatments is further fuelled by the aging population, which is a major consideration because older persons are more prone to cardiovascular problems. The necessity for efficient therapies and the growing awareness of cardiovascular health are driving market expansion and drawing investments in the study and creation of adenosine-related applications in the medical field.

Industry Trend

Increasing focus on the development of Novel Drug Formulation

The increasing emphasis on creating innovative medication formulations and delivery systems that improve adenosine's therapeutic efficacy is one of the noteworthy developments in the global adenosine market. In order to maximize the bioavailability and efficacy of adenosine-based treatments, scientists and pharmaceutical companies are rapidly investigating cutting-edge technologies like sustained-release formulations, nano-encapsulation, and tailored delivery systems. The goal to enhance patient outcomes and lessen the negative effects of conventional administration techniques is what is driving this movement.

Adenosine's possible uses outside of cardiovascular therapies are also gaining attention, especially in fields including immunology, neurology, and oncology. Research on adenosine's effects on immunological response, tumor growth control, and neuroprotection is still ongoing and could lead to new treatment opportunities and a large market expansion. This research is being made possible by the growing cooperation between academics and industry, which is resulting in creative methods and the creation of new products.

Industry Restraint

Strengthen Regulatory environment

The strict regulations governing pharmaceutical products are a major barrier to the global adenosine industry since they might make it difficult to develop and approve novel adenosine-based treatments. Strict guidelines for safety, effectiveness, and manufacturing procedures are enforced by regulatory bodies including the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA). Managing these intricate regulatory criteria might result in drawn-out approval procedures, which can hinder businesses' ability to react quickly to new healthcare demands and postpone the release of novel adenosine formulations onto the market.

Additionally, smaller businesses or startups that specialize on adenosine may find their financial resources stretched by the high cost of research and development related to new drug discovery and formulation. Extensive clinical trials, adherence to legal requirements, and expenditure on cutting-edge drug delivery systems are some of these expenses. Because of this, some prospective competitors might be deterred from joining the market, which would limit competition and innovation.

The competition from alternative therapies for problems like cardiovascular disorders is another limitation. Although adenosine works well in some situations, other treatments might provide comparable or better results with fewer adverse effects or simpler administration. Market expansion may be constrained by this rivalry, especially if medical professionals prefer proven therapies with a longer history of usage.

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Type, Application. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

|

Attributes

|

Details

|

|

Segments

|

By Type

- Below 99% Adenosine

- Above 99% Adenosine

By Application

- Adenosine Triphosphate

- Adenine

- Other

|

|

Region Covered

|

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South Africa

|

|

Key Market Players

|

- Yamasa

- Meihua Group

- Tuoxin

- Mingxin Pharmaceuticla

- Nantong Sane Biological

- Other Key Players

|

|

Report Coverage

|

- Industry Trends

- SWOT Analysis

- PESTEL Analysis

- Porter’s Five Forces Analysis

- Market Competition by Manufacturers

- Key Companies Profiled

- Marketing Channel, Distributors and Customers

- Market Dynamics

- Production and Supply Forecast

- Demand Forecast

- Research Findings and Conclusion

|

| Report Attributes |

Report Details |

| Report Title |

Adenosine Market, Global Outlook and Forecast 2024-2030 |

| Market size in 2024 |

US$ 187.5 million

|

| Forecast Market size by 2030 |

US$ 256.8 million

|

| Growth Rate |

CAGR of 5.4% |

| Historical Year |

2018 to 2022 (Data from 2010 can be provided as per availability) |

| Base Year |

2023 |

| Forecast Year |

2031 |

| Number of Pages |

94 Pages |

| Customization Available |

Yes, the report can be customized as per your need. |

TABLE OF CONTENTS

1 Introduction to Research & Analysis Reports

1.1 Adenosine Market Definition

1.2 Market Segments

1.2.1 Market by Type

1.2.2 Market by Application

1.3 Global Adenosine Market Overview

1.4 Features & Benefits of This Report

1.5 Methodology & Sources of Information

1.5.1 Research Methodology

1.5.2 Research Process

1.5.3 Base Year

1.5.4 Report Assumptions & Caveats

2 Global Adenosine Overall Market Size

2.1 Global Adenosine Market Size: 2023 VS 2030

2.2 Global Adenosine Revenue, Prospects & Forecasts: 2019-2030

2.3 Global Adenosine Sales: 2019-2030

3 Company Landscape

3.1 Top Adenosine Players in Global Market

3.2 Top Global Adenosine Companies Ranked by Revenue

3.3 Global Adenosine Revenue by Companies

3.4 Global Adenosine Sales by Companies

3.5 Global Adenosine Price by Manufacturer (2019-2024)

3.6 Top 3 and Top 5 Adenosine Companies in Global Market, by Revenue in 2023

3.7 Global Manufacturers Adenosine Product Type

3.8 Tier 1, Tier 2 and Tier 3 Adenosine Players in Global Market

3.8.1 List of Global Tier 1 Adenosine Companies

3.8.2 List of Global Tier 2 and Tier 3 Adenosine Companies

4 Sights by Product

4.1 Overview

4.1.1 By Type - Global Adenosine Market Size Markets, 2023 & 2030

4.1.2 ? 99% Adenosine

4.1.3 ? 99% Adenosine

4.2 By Type - Global Adenosine Revenue & Forecasts

4.2.1 By Type - Global Adenosine Revenue, 2019-2024

4.2.2 By Type - Global Adenosine Revenue, 2025-2030

4.2.3 By Type - Global Adenosine Revenue Market Share, 2019-2030

4.3 By Type - Global Adenosine Sales & Forecasts

4.3.1 By Type - Global Adenosine Sales, 2019-2024

4.3.2 By Type - Global Adenosine Sales, 2025-2030

4.3.3 By Type - Global Adenosine Sales Market Share, 2019-2030

4.4 By Type - Global Adenosine Price (Manufacturers Selling Prices), 2019-2030

5 Sights by Application

5.1 Overview

5.1.1 By Application - Global Adenosine Market Size, 2023 & 2030

5.1.2 Adenosine Triphosphate

5.1.3 Adenine

5.1.4 Other

5.2 By Application - Global Adenosine Revenue & Forecasts

5.2.1 By Application - Global Adenosine Revenue, 2019-2024

5.2.2 By Application - Global Adenosine Revenue, 2025-2030

5.2.3 By Application - Global Adenosine Revenue Market Share, 2019-2030

5.3 By Application - Global Adenosine Sales & Forecasts

5.3.1 By Application - Global Adenosine Sales, 2019-2024

5.3.2 By Application - Global Adenosine Sales, 2025-2030

5.3.3 By Application - Global Adenosine Sales Market Share, 2019-2030

5.4 By Application - Global Adenosine Price (Manufacturers Selling Prices), 2019-2030

6 Sights by Region

6.1 By Region - Global Adenosine Market Size, 2023 & 2030

6.2 By Region - Global Adenosine Revenue & Forecasts

6.2.1 By Region - Global Adenosine Revenue, 2019-2024

6.2.2 By Region - Global Adenosine Revenue, 2025-2030

6.2.3 By Region - Global Adenosine Revenue Market Share, 2019-2030

6.3 By Region - Global Adenosine Sales & Forecasts

6.3.1 By Region - Global Adenosine Sales, 2019-2024

6.3.2 By Region - Global Adenosine Sales, 2025-2030

6.3.3 By Region - Global Adenosine Sales Market Share, 2019-2030

6.4 North America

6.4.1 By Country - North America Adenosine Revenue, 2019-2030

6.4.2 By Country - North America Adenosine Sales, 2019-2030

6.4.3 US Adenosine Market Size, 2019-2030

6.4.4 Canada Adenosine Market Size, 2019-2030

6.4.5 Mexico Adenosine Market Size, 2019-2030

6.5 Europe

6.5.1 By Country - Europe Adenosine Revenue, 2019-2030

6.5.2 By Country - Europe Adenosine Sales, 2019-2030

6.5.3 Germany Adenosine Market Size, 2019-2030

6.5.4 France Adenosine Market Size, 2019-2030

6.5.5 U.K. Adenosine Market Size, 2019-2030

6.5.6 Italy Adenosine Market Size, 2019-2030

6.5.7 Russia Adenosine Market Size, 2019-2030

6.5.8 Nordic Countries Adenosine Market Size, 2019-2030

6.5.9 Benelux Adenosine Market Size, 2019-2030

6.6 Asia

6.6.1 By Region - Asia Adenosine Revenue, 2019-2030

6.6.2 By Region - Asia Adenosine Sales, 2019-2030

6.6.3 China Adenosine Market Size, 2019-2030

6.6.4 Japan Adenosine Market Size, 2019-2030

6.6.5 South Korea Adenosine Market Size, 2019-2030

6.6.6 Southeast Asia Adenosine Market Size, 2019-2030

6.6.7 India Adenosine Market Size, 2019-2030

6.7 South America

6.7.1 By Country - South America Adenosine Revenue, 2019-2030

6.7.2 By Country - South America Adenosine Sales, 2019-2030

6.7.3 Brazil Adenosine Market Size, 2019-2030

6.7.4 Argentina Adenosine Market Size, 2019-2030

6.8 Middle East & Africa

6.8.1 By Country - Middle East & Africa Adenosine Revenue, 2019-2030

6.8.2 By Country - Middle East & Africa Adenosine Sales, 2019-2030

6.8.3 Turkey Adenosine Market Size, 2019-2030

6.8.4 Israel Adenosine Market Size, 2019-2030

6.8.5 Saudi Arabia Adenosine Market Size, 2019-2030

6.8.6 UAE Adenosine Market Size, 2019-2030

7 Manufacturers & Brands Profiles

7.1 Yamasa

7.1.1 Yamasa Company Summary

7.1.2 Yamasa Business Overview

7.1.3 Yamasa Adenosine Major Product Offerings

7.1.4 Yamasa Adenosine Sales and Revenue in Global (2019-2024)

7.1.5 Yamasa Key News & Latest Developments

7.2 Meihua Group

7.2.1 Meihua Group Company Summary

7.2.2 Meihua Group Business Overview

7.2.3 Meihua Group Adenosine Major Product Offerings

7.2.4 Meihua Group Adenosine Sales and Revenue in Global (2019-2024)

7.2.5 Meihua Group Key News & Latest Developments

7.3 Wockhardt

7.3.1 Wockhardt Company Summary

7.3.2 Wockhardt Business Overview

7.3.3 Wockhardt Adenosine Major Product Offerings

7.3.4 Wockhardt Adenosine Sales and Revenue in Global (2019-2024)

7.3.5 Wockhardt Key News & Latest Developments

7.4 Star Lake Bioscience

7.4.1 Star Lake Bioscience Company Summary

7.4.2 Star Lake Bioscience Business Overview

7.4.3 Star Lake Bioscience Adenosine Major Product Offerings

7.4.4 Star Lake Bioscience Adenosine Sales and Revenue in Global (2019-2024)

7.4.5 Star Lake Bioscience Key News & Latest Developments

7.5 Nantong Sane Biological

7.5.1 Nantong Sane Biological Company Summary

7.5.2 Nantong Sane Biological Business Overview

7.5.3 Nantong Sane Biological Adenosine Major Product Offerings

7.5.4 Nantong Sane Biological Adenosine Sales and Revenue in Global (2019-2024)

7.5.5 Nantong Sane Biological Key News & Latest Developments

7.6 Henan Julong Biological Engineering

7.6.1 Henan Julong Biological Engineering Company Summary

7.6.2 Henan Julong Biological Engineering Business Overview

7.6.3 Henan Julong Biological Engineering Adenosine Major Product Offerings

7.6.4 Henan Julong Biological Engineering Adenosine Sales and Revenue in Global (2019-2024)

7.6.5 Henan Julong Biological Engineering Key News & Latest Developments

7.7 Zhejiang Hisun Pharmaceutical

7.7.1 Zhejiang Hisun Pharmaceutical Company Summary

7.7.2 Zhejiang Hisun Pharmaceutical Business Overview

7.7.3 Zhejiang Hisun Pharmaceutical Adenosine Major Product Offerings

7.7.4 Zhejiang Hisun Pharmaceutical Adenosine Sales and Revenue in Global (2019-2024)

7.7.5 Zhejiang Hisun Pharmaceutical Key News & Latest Developments

7.8 Nantong Sane Biological

7.8.1 Nantong Sane Biological Company Summary

7.8.2 Nantong Sane Biological Business Overview

7.8.3 Nantong Sane Biological Adenosine Major Product Offerings

7.8.4 Nantong Sane Biological Adenosine Sales and Revenue in Global (2019-2024)

7.8.5 Nantong Sane Biological Key News & Latest Developments

8 Global Adenosine Production Capacity, Analysis

8.1 Global Adenosine Production Capacity, 2019-2030

8.2 Adenosine Production Capacity of Key Manufacturers in Global Market

8.3 Global Adenosine Production by Region

9 Key Market Trends, Opportunity, Drivers and Restraints

9.1 Market Opportunities & Trends

9.2 Market Drivers

9.3 Market Restraints

10 Adenosine Supply Chain Analysis

10.1 Adenosine Industry Value Chain

10.2 Adenosine Upstream Market

10.3 Adenosine Downstream and Clients

10.4 Marketing Channels Analysis

10.4.1 Marketing Channels

10.4.2 Adenosine Distributors and Sales Agents in Global

11 Conclusion

12 Appendix

12.1 Note

12.2 Examples of Clients

12.3 Disclaimer

LIST OF TABLES & FIGURES

List of Tables

Table 1. Key Players of Adenosine in Global Market

Table 2. Top Adenosine Players in Global Market, Ranking by Revenue (2023)

Table 3. Global Adenosine Revenue by Companies, (US$, Mn), 2019-2024

Table 4. Global Adenosine Revenue Share by Companies, 2019-2024

Table 5. Global Adenosine Sales by Companies, (MT), 2019-2024

Table 6. Global Adenosine Sales Share by Companies, 2019-2024

Table 7. Key Manufacturers Adenosine Price (2019-2024) & (USD/Kg)

Table 8. Global Manufacturers Adenosine Product Type

Table 9. List of Global Tier 1 Adenosine Companies, Revenue (US$, Mn) in 2023 and Market Share

Table 10. List of Global Tier 2 and Tier 3 Adenosine Companies, Revenue (US$, Mn) in 2023 and Market Share

Table 11. By Type ? Global Adenosine Revenue, (US$, Mn), 2023 & 2030

Table 12. By Type - Global Adenosine Revenue (US$, Mn), 2019-2024

Table 13. By Type - Global Adenosine Revenue (US$, Mn), 2025-2030

Table 14. By Type - Global Adenosine Sales (MT), 2019-2024

Table 15. By Type - Global Adenosine Sales (MT), 2025-2030

Table 16. By Application ? Global Adenosine Revenue, (US$, Mn), 2023 & 2030

Table 17. By Application - Global Adenosine Revenue (US$, Mn), 2019-2024

Table 18. By Application - Global Adenosine Revenue (US$, Mn), 2025-2030

Table 19. By Application - Global Adenosine Sales (MT), 2019-2024

Table 20. By Application - Global Adenosine Sales (MT), 2025-2030

Table 21. By Region ? Global Adenosine Revenue, (US$, Mn), 2023 VS 2030

Table 22. By Region - Global Adenosine Revenue (US$, Mn), 2019-2024

Table 23. By Region - Global Adenosine Revenue (US$, Mn), 2025-2030

Table 24. By Region - Global Adenosine Sales (MT), 2019-2024

Table 25. By Region - Global Adenosine Sales (MT), 2025-2030

Table 26. By Country - North America Adenosine Revenue, (US$, Mn), 2019-2024

Table 27. By Country - North America Adenosine Revenue, (US$, Mn), 2025-2030

Table 28. By Country - North America Adenosine Sales, (MT), 2019-2024

Table 29. By Country - North America Adenosine Sales, (MT), 2025-2030

Table 30. By Country - Europe Adenosine Revenue, (US$, Mn), 2019-2024

Table 31. By Country - Europe Adenosine Revenue, (US$, Mn), 2025-2030

Table 32. By Country - Europe Adenosine Sales, (MT), 2019-2024

Table 33. By Country - Europe Adenosine Sales, (MT), 2025-2030

Table 34. By Region - Asia Adenosine Revenue, (US$, Mn), 2019-2024

Table 35. By Region - Asia Adenosine Revenue, (US$, Mn), 2025-2030

Table 36. By Region - Asia Adenosine Sales, (MT), 2019-2024

Table 37. By Region - Asia Adenosine Sales, (MT), 2025-2030

Table 38. By Country - South America Adenosine Revenue, (US$, Mn), 2019-2024

Table 39. By Country - South America Adenosine Revenue, (US$, Mn), 2025-2030

Table 40. By Country - South America Adenosine Sales, (MT), 2019-2024

Table 41. By Country - South America Adenosine Sales, (MT), 2025-2030

Table 42. By Country - Middle East & Africa Adenosine Revenue, (US$, Mn), 2019-2024

Table 43. By Country - Middle East & Africa Adenosine Revenue, (US$, Mn), 2025-2030

Table 44. By Country - Middle East & Africa Adenosine Sales, (MT), 2019-2024

Table 45. By Country - Middle East & Africa Adenosine Sales, (MT), 2025-2030

Table 46. Yamasa Company Summary

Table 47. Yamasa Adenosine Product Offerings

Table 48. Yamasa Adenosine Sales (MT), Revenue (US$, Mn) and Average Price (USD/Kg) (2019-2024)

Table 49. Yamasa Key News & Latest Developments

Table 50. Meihua Group Company Summary

Table 51. Meihua Group Adenosine Product Offerings

Table 52. Meihua Group Adenosine Sales (MT), Revenue (US$, Mn) and Average Price (USD/Kg) (2019-2024)

Table 53. Meihua Group Key News & Latest Developments

Table 54. Wockhardt Company Summary

Table 55. Wockhardt Adenosine Product Offerings

Table 56. Wockhardt Adenosine Sales (MT), Revenue (US$, Mn) and Average Price (USD/Kg) (2019-2024)

Table 57. Wockhardt Key News & Latest Developments

Table 58. Star Lake Bioscience Company Summary

Table 59. Star Lake Bioscience Adenosine Product Offerings

Table 60. Star Lake Bioscience Adenosine Sales (MT), Revenue (US$, Mn) and Average Price (USD/Kg) (2019-2024)

Table 61. Star Lake Bioscience Key News & Latest Developments

Table 62. Nantong Sane Biological Company Summary

Table 63. Nantong Sane Biological Adenosine Product Offerings

Table 64. Nantong Sane Biological Adenosine Sales (MT), Revenue (US$, Mn) and Average Price (USD/Kg) (2019-2024)

Table 65. Nantong Sane Biological Key News & Latest Developments

Table 66. Henan Julong Biological Engineering Company Summary

Table 67. Henan Julong Biological Engineering Adenosine Product Offerings

Table 68. Henan Julong Biological Engineering Adenosine Sales (MT), Revenue (US$, Mn) and Average Price (USD/Kg) (2019-2024)

Table 69. Henan Julong Biological Engineering Key News & Latest Developments

Table 70. Zhejiang Hisun Pharmaceutical Company Summary

Table 71. Zhejiang Hisun Pharmaceutical Adenosine Product Offerings

Table 72. Zhejiang Hisun Pharmaceutical Adenosine Sales (MT), Revenue (US$, Mn) and Average Price (USD/Kg) (2019-2024)

Table 73. Zhejiang Hisun Pharmaceutical Key News & Latest Developments

Table 74. Nantong Sane Biological Company Summary

Table 75. Nantong Sane Biological Adenosine Product Offerings

Table 76. Nantong Sane Biological Adenosine Sales (MT), Revenue (US$, Mn) and Average Price (USD/Kg) (2019-2024)

Table 77. Nantong Sane Biological Key News & Latest Developments

Table 78. Adenosine Production Capacity (MT) of Key Manufacturers in Global Market, 2022-2024 (MT)

Table 79. Global Adenosine Capacity Market Share of Key Manufacturers, 2022-2024

Table 80. Global Adenosine Production by Region, 2019-2024 (MT)

Table 81. Global Adenosine Production by Region, 2025-2030 (MT)

Table 82. Adenosine Market Opportunities & Trends in Global Market

Table 83. Adenosine Market Drivers in Global Market

Table 84. Adenosine Market Restraints in Global Market

Table 85. Adenosine Raw Materials

Table 86. Adenosine Raw Materials Suppliers in Global Market

Table 87. Typical Adenosine Downstream

Table 88. Adenosine Downstream Clients in Global Market

Table 89. Adenosine Distributors and Sales Agents in Global Market

List of Figures

Figure 1. Adenosine Segment by Type in 2023

Figure 2. Adenosine Segment by Application in 2023

Figure 3. Global Adenosine Market Overview: 2023

Figure 4. Key Caveats

Figure 5. Global Adenosine Market Size: 2023 VS 2030 (US$, Mn)

Figure 6. Global Adenosine Revenue, 2019-2030 (US$, Mn)

Figure 7. Adenosine Sales in Global Market: 2019-2030 (MT)

Figure 8. The Top 3 and 5 Players Market Share by Adenosine Revenue in 2023

Figure 9. By Type - Global Adenosine Revenue, (US$, Mn), 2023 & 2030

Figure 10. By Type - Global Adenosine Revenue Market Share, 2019-2030

Figure 11. By Type - Global Adenosine Sales Market Share, 2019-2030

Figure 12. By Type - Global Adenosine Price (USD/Kg), 2019-2030

Figure 13. By Application - Global Adenosine Revenue, (US$, Mn), 2023 & 2030

Figure 14. By Application - Global Adenosine Revenue Market Share, 2019-2030

Figure 15. By Application - Global Adenosine Sales Market Share, 2019-2030

Figure 16. By Application - Global Adenosine Price (USD/Kg), 2019-2030

Figure 17. By Region - Global Adenosine Revenue, (US$, Mn), 2023 & 2030

Figure 18. By Region - Global Adenosine Revenue Market Share, 2019 VS 2023 VS 2030

Figure 19. By Region - Global Adenosine Revenue Market Share, 2019-2030

Figure 20. By Region - Global Adenosine Sales Market Share, 2019-2030

Figure 21. By Country - North America Adenosine Revenue Market Share, 2019-2030

Figure 22. By Country - North America Adenosine Sales Market Share, 2019-2030

Figure 23. US Adenosine Revenue, (US$, Mn), 2019-2030

Figure 24. Canada Adenosine Revenue, (US$, Mn), 2019-2030

Figure 25. Mexico Adenosine Revenue, (US$, Mn), 2019-2030

Figure 26. By Country - Europe Adenosine Revenue Market Share, 2019-2030

Figure 27. By Country - Europe Adenosine Sales Market Share, 2019-2030

Figure 28. Germany Adenosine Revenue, (US$, Mn), 2019-2030

Figure 29. France Adenosine Revenue, (US$, Mn), 2019-2030

Figure 30. U.K. Adenosine Revenue, (US$, Mn), 2019-2030

Figure 31. Italy Adenosine Revenue, (US$, Mn), 2019-2030

Figure 32. Russia Adenosine Revenue, (US$, Mn), 2019-2030

Figure 33. Nordic Countries Adenosine Revenue, (US$, Mn), 2019-2030

Figure 34. Benelux Adenosine Revenue, (US$, Mn), 2019-2030

Figure 35. By Region - Asia Adenosine Revenue Market Share, 2019-2030

Figure 36. By Region - Asia Adenosine Sales Market Share, 2019-2030

Figure 37. China Adenosine Revenue, (US$, Mn), 2019-2030

Figure 38. Japan Adenosine Revenue, (US$, Mn), 2019-2030

Figure 39. South Korea Adenosine Revenue, (US$, Mn), 2019-2030

Figure 40. Southeast Asia Adenosine Revenue, (US$, Mn), 2019-2030

Figure 41. India Adenosine Revenue, (US$, Mn), 2019-2030

Figure 42. By Country - South America Adenosine Revenue Market Share, 2019-2030

Figure 43. By Country - South America Adenosine Sales Market Share, 2019-2030

Figure 44. Brazil Adenosine Revenue, (US$, Mn), 2019-2030

Figure 45. Argentina Adenosine Revenue, (US$, Mn), 2019-2030

Figure 46. By Country - Middle East & Africa Adenosine Revenue Market Share, 2019-2030

Figure 47. By Country - Middle East & Africa Adenosine Sales Market Share, 2019-2030

Figure 48. Turkey Adenosine Revenue, (US$, Mn), 2019-2030

Figure 49. Israel Adenosine Revenue, (US$, Mn), 2019-2030

Figure 50. Saudi Arabia Adenosine Revenue, (US$, Mn), 2019-2030

Figure 51. UAE Adenosine Revenue, (US$, Mn), 2019-2030

Figure 52. Global Adenosine Production Capacity (MT), 2019-2030

Figure 53. The Percentage of Production Adenosine by Region, 2023 VS 2030

Figure 54. Adenosine Industry Value Chain

Figure 55. Marketing Channels

Click for best price

Click for best price