TOP CATEGORY: Chemicals & Materials | Life Sciences | Banking & Finance | ICT Media

Download Report PDF Instantly

Report overview

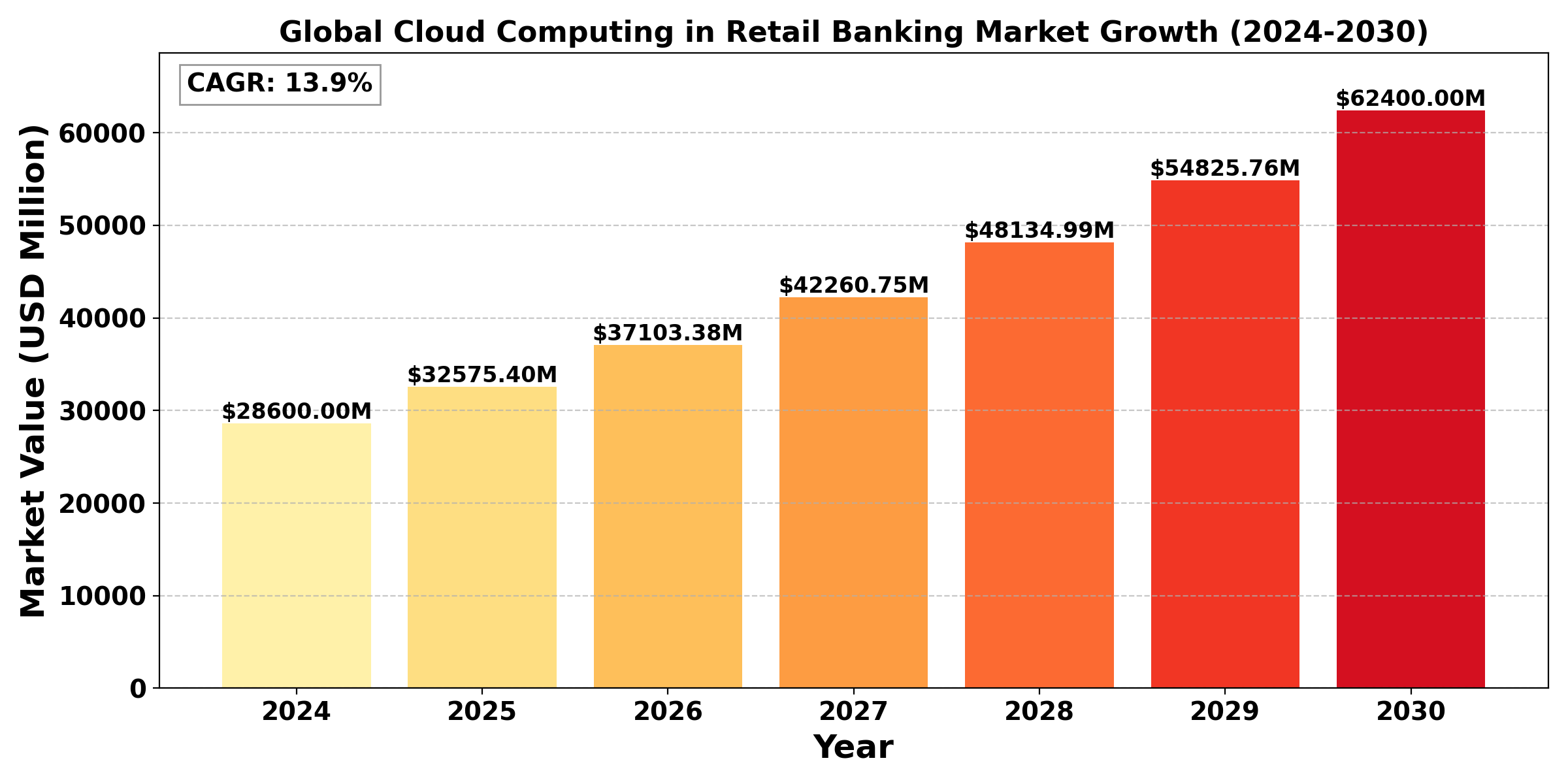

The "Global Cloud Computing in Retail Banking Market" size was valued at US$ 28.6 billion in 2024 and is projected to reach US$ 62.4 billion by 2030, at a CAGR of 13.9% during the forecast period 2024-2030.

The "United States Cloud Computing in Retail Banking Market" size was valued at US$ 7.6 billion in 2024 and is projected to reach US$ 15.8 billion by 2030, at a CAGR of 13.0% during the forecast period 2024-2030.

Cloud Computing in Retail Banking refers to the use of cloud-based technologies and services by retail banks to enhance their operations, improve customer experiences, and drive innovation. By leveraging cloud infrastructure, retail banks can securely store data, optimize processes, and deliver services faster and more efficiently. Key applications include customer data management, fraud detection, personalized financial services, digital banking solutions, and data analytics. Cloud computing enables banks to scale resources on demand, reduce IT costs, and improve compliance with regulatory standards. This transformation helps banks stay competitive and responsive to evolving customer needs in a digital-first environment.

The adoption of cloud-based technologies and services by retail banks for core banking operations, customer relationship management, and digital banking platforms.

The global Cloud Computing in Retail Banking market is showing strong growth, driven by the need for scalable and flexible IT infrastructure, increasing focus on digital transformation, and the potential for cost reduction and improved efficiency. Key players include Amazon Web Services, Microsoft Azure, and IBM Cloud. In 2024, Software-as-a-Service (SaaS) solutions accounted for 48% of the market, with Platform-as-a-Service (PaaS) growing at 15.2% annually. The industry is seeing significant adoption of hybrid cloud models, now used by 65% of major retail banks. There's increasing demand for AI and machine learning capabilities in cloud platforms, enhancing fraud detection efficiency by up to 40%. Banks are investing in cloud-native application development, reducing time-to-market for new services by 50%. The market is benefiting from regulatory acceptance of cloud technologies and improved security measures. Challenges include ensuring data privacy compliance across jurisdictions and managing the complexity of legacy system integration. The US market leads in cloud adoption, with an average of 35% of IT budgets allocated to cloud services in large retail banks.

Report Overview

This report provides a deep insight into the global Cloud Computing in Retail Banking market covering all its essential aspects. This ranges from a macro overview of the market to micro details of the market size, competitive landscape, development trend, niche market, key market drivers and challenges, SWOT analysis, value chain analysis, etc.

The analysis helps the reader to shape the competition within the industries and strategies for the competitive environment to enhance the potential profit. Furthermore, it provides a simple framework for evaluating and accessing the position of the business organization. The report structure also focuses on the competitive landscape of the Global Cloud Computing in Retail Banking Market, this report introduces in detail the market share, market performance, product situation, operation situation, etc. of the main players, which helps the readers in the industry to identify the main competitors and deeply understand the competition pattern of the market.

In a word, this report is a must-read for industry players, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Cloud Computing in Retail Banking market in any manner.

Global Cloud Computing in Retail Banking Market: Market Segmentation Analysis

The research report includes specific segments by region (country), manufacturers, Type, and Application. Market segmentation creates subsets of a market based on product type, end-user or application, Geographic, and other factors. By understanding the market segments, the decision-maker can leverage this targeting in the product, sales, and marketing strategies. Market segments can power your product development cycles by informing how you create product offerings for different segments.

Key Company

Chapter Outline

Chapter 1 mainly introduces the statistical scope of the report, market division standards, and market research methods.

Chapter 2 is an executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the Cloud Computing in Retail Banking Market and its likely evolution in the short to mid-term, and long term.

Chapter 3 makes a detailed analysis of the market's competitive landscape of the market and provides the market share, capacity, output, price, latest development plan, merger, and acquisition information of the main manufacturers in the market.

Chapter 4 is the analysis of the whole market industrial chain, including the upstream and downstream of the industry, as well as Porter's five forces analysis.

Chapter 5 introduces the latest developments of the market, the driving factors and restrictive factors of the market, the challenges and risks faced by manufacturers in the industry, and the analysis of relevant policies in the industry.

Chapter 6 provides the analysis of various market segments according to product types, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 7 provides the analysis of various market segments according to application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 8 provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and capacity of each country in the world.

Chapter 9 introduces the basic situation of the main companies in the market in detail, including product sales revenue, sales volume, price, gross profit margin, market share, product introduction, recent development, etc.

Chapter 10 provides a quantitative analysis of the market size and development potential of each region in the next five years.

Chapter 11 provides a quantitative analysis of the market size and development potential of each market segment (product type and application) in the next five years.

Chapter 12 is the main points and conclusions of the report.