TOP CATEGORY: Chemicals & Materials | Life Sciences | Banking & Finance | ICT Media

Download Report PDF Instantly

Report overview

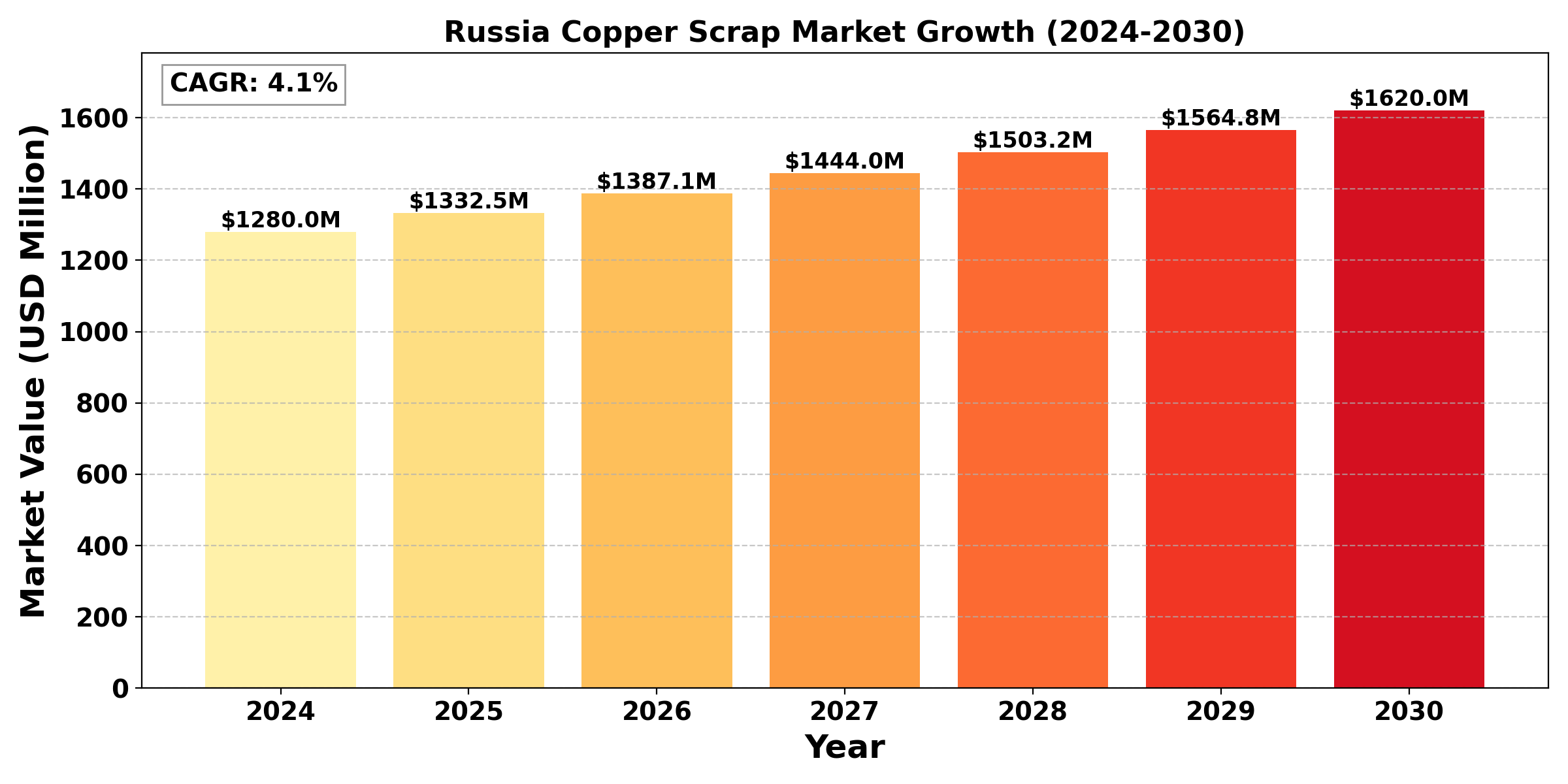

"Russia Copper Scrap Market" was valued at US$ 1.28 billion in 2024 and is projected to reach US$ 1.62 billion by 2030, at a CAGR of 4.1% during the forecast period 2024-2030.

Russia's copper scrap business is an important part of the nation's metals recycling and supply chain because copper is a vital component of industries including manufacturing, electronics, and construction. Recycled copper is becoming more and more valuable due to the worldwide trend towards sustainable practices and the domestic demand for copper in infrastructure projects. One of the largest producers of copper in the world is Russia, and the scrap sector helps to lessen dependency on the production of virgin copper, which in turn reduces energy use and greenhouse gas emissions. Regulatory obstacles, shifting global copper prices, and rivalry from other scrap-producing nations are some of the difficulties the business faces. Notwithstanding these obstacles, the expansion of Russia's copper scrap business is anticipated to be aided in the upcoming years by improvements in recycling technologies and the need for more environmentally friendly manufacturing practices.

By offering a more affordable option to primary copper extraction, which can be resource and capital-intensive, Russia's copper scrap business contributes significantly to the country's economy in addition to its environmental advantages. Due to the nation's extensive industrial base and sizable cities, a sizable amount of copper scrap is produced, which is obtained from outdated electrical equipment, construction trash, and machinery. By gathering, processing, and reintroducing this scrap into the supply chain, fewer new mining operations are required. Due to their significant need for copper in manufacturing and electronics, China, India, and other Asian markets are important export destinations for Russia's copper scrap market. But the business also faces challenges including illegal scrap trading, which has led the government to try to better regulate and oversee the market. Despite the challenges of geopolitical tensions and international trade limitations, Russia is well-positioned to increase its role in the global copper recycling industry thanks to its advantageous geographic location, wealth of waste resources, and growing emphasis on sustainability.

In terms of type, the Russian copper scrap market has been segmented as Bare Bright Copper,

Among the several market segments, Bare Bright Copper has the largest market share in Russia's copper scrap industry. The purity of this kind of copper scrap, which usually consists of unoxidized, uncoated, and unalloyed copper wire free of impurities like solder, coatings, or insulation, makes it extremely valuable. It is the most precious and sought-after type of scrap due to its high copper content (often 99.9%), which requires little processing before being used again in manufacture or refining. Bare Bright Copper is highly valued in both domestic and foreign markets because of its exceptional quality, especially in fields where high conductivity is crucial, like electronics, wiring, and electrical applications.

Because it can be readily remelted and used again without requiring a lot of processing or refining, bare bright copper is also in high demand due to its ease of recycling. This makes it very appealing in a sector that aims to maximise productivity and cut expenses. Although other types of copper scrap, such as No. 1 copper, No. 2 copper, and insulated copper wire, are also important, they are usually less valued than bare bright copper due to their lower copper content or the necessity for additional processing. Thus, because of its excellent quality, adaptability, and high demand in energy-efficient and sustainable applications, bare bright copper continues to dominate the Russian copper scrap market.

Electrical and Electronics sector to hold the highest market share: By Source

In terms of Source the Russia Copper Scrap Market has been segmented as Electrical and Electronics, Construction and Infrastructure, Industrial Machinery, Automotive and Others (Plumbing, Household Items, etc.)

The electrical and electronics sector has the largest market share in the Russian copper scrap industry. This dominance results from copper's extensive use in circuit boards, electrical wiring, cables, and transformers—all essential parts of the electronics production process. Because of its high conductivity, copper is essential for power transmission and generation, which fuels steady demand from this industry. Copper's recovery from electronic trash is further enhanced by the rise of renewable energy initiatives, growing urbanisation, and telecommunications expansion. Government programs encouraging sustainable practices in Russia's industrial sectors also help with copper recycling from this section.

Since copper is a key component of renewable energy systems, the growth of renewable energy projects in Russia, such as wind and solar power, adds to the country's reliance on copper for electrical uses. The need for effective power distribution systems that mostly rely on copper is being driven by the move towards smart grids, higher electrification, and urbanisation. In addition to increasing the use of copper, these improvements result in a large amount of scrap when outdated infrastructure is modernised or retired.

A combination of large, vertically integrated businesses and small- and medium-sized recyclers influence competition in Russia's copper scrap market. With their vast recycling operations and established positions in copper production and processing, major firms like Norilsk Nickel and the Russian Copper Company (RCC) control the market. Because of its integrated supply chain, which enables it to recycle scrap and keep a consistent supply of copper for home use, RCC is very powerful. Due to the inefficiencies of Russia's unofficial scrap collection system and restricted access to cutting-edge recycling equipment, smaller recyclers find it difficult to grow. Government laws also have an impact on the market.

Government policies also have an impact on the market. For example, export restrictions restrict the quantity of scrap that may be sold elsewhere, guaranteeing that domestic need is satisfied first. Demand for recycled copper will rise as the market expands, particularly due to the growing emphasis on electric vehicles and renewable energy infrastructure. Businesses who can handle Russia's logistical difficulties and make investments in cutting-edge recycling technologies stand to benefit from a competitive advantage.

November 9th, 2023, Metalloinvest announced a technical partnership agreement with China’s Lee Jun. “Our partnership with Lee Jun is a significant milestone in terms of ensuring the stable operation and technical development of our HBI production facility. HBI, a low-carbon feedstock for the production of green steel, is our flagship product,” said Mr Krestinin.

May 7th, 2024, Lebedinsky GOK announced the acquisition of state-of-the-art amphibious dredger.

December 14th 2023, Norilsk Nickel announced the relocation of Bystra to Russia. Vladimir Potanin, President of Nornickel, commented: “Bystra is one of Nornickel’s most modern businesses. The move to the Russian jurisdiction will allow our Zabaikalsky asset not only to protect the interests of all shareholders, but also to maintain high standards of corporate governance and invest in the domestic economy, including the Far East regions”.

The end-use industry analysis of Russia's copper scrap market highlights several sectors driving demand for recycled copper. One of the most important end-use sectors is construction and infrastructure, where copper is utilised in roofing, wiring, and plumbing materials. As Russia continues to invest in large-scale infrastructure projects, urban development, and the modernization of its electrical grids, demand for recycled copper remains high in this sector. The durability and conductivity of copper make it a preferred material for both residential and commercial buildings, reinforcing its importance in sustainable construction practices.

Since the industry uses copper extensively to manufacture electrical components and electronic gadgets, electrical and electronics also play a big part. Copper use is being driven by the increasing need for consumer electronics, renewable energy systems, and telecommunications infrastructure; recycled copper is an essential component in supplying this demand. The drive to increase recycling rates and decrease e-waste also reinforces this industry's contribution to the use of copper scrap.

The move to electric vehicles (EVs) in the automotive sector is increasing demand for copper. Compared to conventional internal combustion engine vehicles, EVs consume a lot more copper, especially for wiring, electric motors, and charging infrastructure. The automobile industry is emerging as a crucial end-use market for copper scrap as Russia's EV market grows, assisting producers in lowering production costs.

Infrastructure Development and Modernization efforts

The development and modernisation of Russia's infrastructure is one of the main factors propelling the Russia copper scrap sector. Russia has been making significant investments to modernise its deteriorating transportation and electrical networks, as well as its residential and commercial structures. Copper is an essential component of these projects because of its superior conductivity, robustness, and recyclable nature. The nation's need for copper in electrical, plumbing, and wiring components is growing as it modernises its electrical grids, urbanises, and develops its transportation infrastructure. The expansion of the copper scrap sector is a direct result of this spike in infrastructure initiatives. As the price of raw materials varies and environmental concerns grow, recycled copper provides a viable and affordable substitute for freshly extracted copper. Furthermore, enterprises are being encouraged to adopt more environmentally friendly techniques, such as recycling copper from scrap materials, by the Russian government's emphasis on sustainability projects and the circular economy.

The expansion of copper scrap processing and utilisation is being driven by the demand for modern, effective infrastructure as well as regulatory support for sustainability and recycling. This strengthens the value of the copper scrap business in relation to Russia's larger economic and environmental objectives by guaranteeing a consistent supply of copper for infrastructure-related projects.

Increased focus on the Circular Economy and Sustainable Practices

The growing emphasis on sustainable practices and the circular economy is a major trend influencing the Russian copper scrap market. Industries are moving towards waste reduction, resource conservation, and carbon footprint minimisation as environmental concerns increase both domestically and internationally. This tendency is especially noticeable in the market for copper scrap, where recycling is emerging as a crucial tactic to satisfy the growing demand for copper without having an adverse effect on the environment like new mining would. Additionally, the Russian government is encouraging sustainability projects by using incentives and laws to pressure enterprises to adopt more environmentally friendly practices. Technological developments in recycling procedures, which are increasing the effectiveness and economy of copper recovery, further reinforce this trend. Because recycled copper is less expensive, uses less energy, and is better for the environment, businesses in industries like electronics, automotive, and construction are increasingly choosing it.

The use of scrap copper as a dependable and sustainable source is also becoming more popular as a result of global supply chain disruptions and shifting raw material costs. This change makes copper recycling a crucial component of Russia's industrial environment and aids companies in stabilising supply chains while also supporting the larger movement towards sustainability.

Volatility in Global Copper Prices and fluctuating Supply of Scrap Materials.

The variable supply of scrap materials and the volatility of global copper prices are two of the biggest obstacles facing the Russian copper scrap business. Geopolitical tensions, international trade regulations, and shifts in demand from important industries like electronics and construction all have an impact on copper prices, which are extremely sensitive to global market dynamics. Businesses that recycle copper scrap may find it difficult to sustain steady profitability as a result of these price fluctuations.

Furthermore, economic cycles and the general level of industrial activity have a direct impact on the availability of scrap copper. The availability of scrap copper tends to decline during times of economic slowdown or decreased industrial activity, which restricts the amount of material that may be recycled. The industry's capacity to satisfy the growing demand for recycled copper across a range of industries may be hampered by this supply volatility.

In addition, various collecting and sorting methods throughout Russia may make matters worse by resulting in ineffective scrap collection and processing. These elements, along with the volatility of the world market, pose a serious barrier to the expansion of the copper scrap sector, making it challenging for companies to plan ahead and run their operations in a sustainable and steady way.

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis Type, Source, End-use industry, Application. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors

|

Attributes |

Details |

|

Segments |

By Type:

By Source:

By Application:

By End Use Industry:

|

|

Region Covered |

|

|

Key Market Players |

|

|

Report Coverage |

|