TOP CATEGORY: Chemicals & Materials | Life Sciences | Banking & Finance | ICT Media

Download Report PDF Instantly

Report overview

Industry Overview

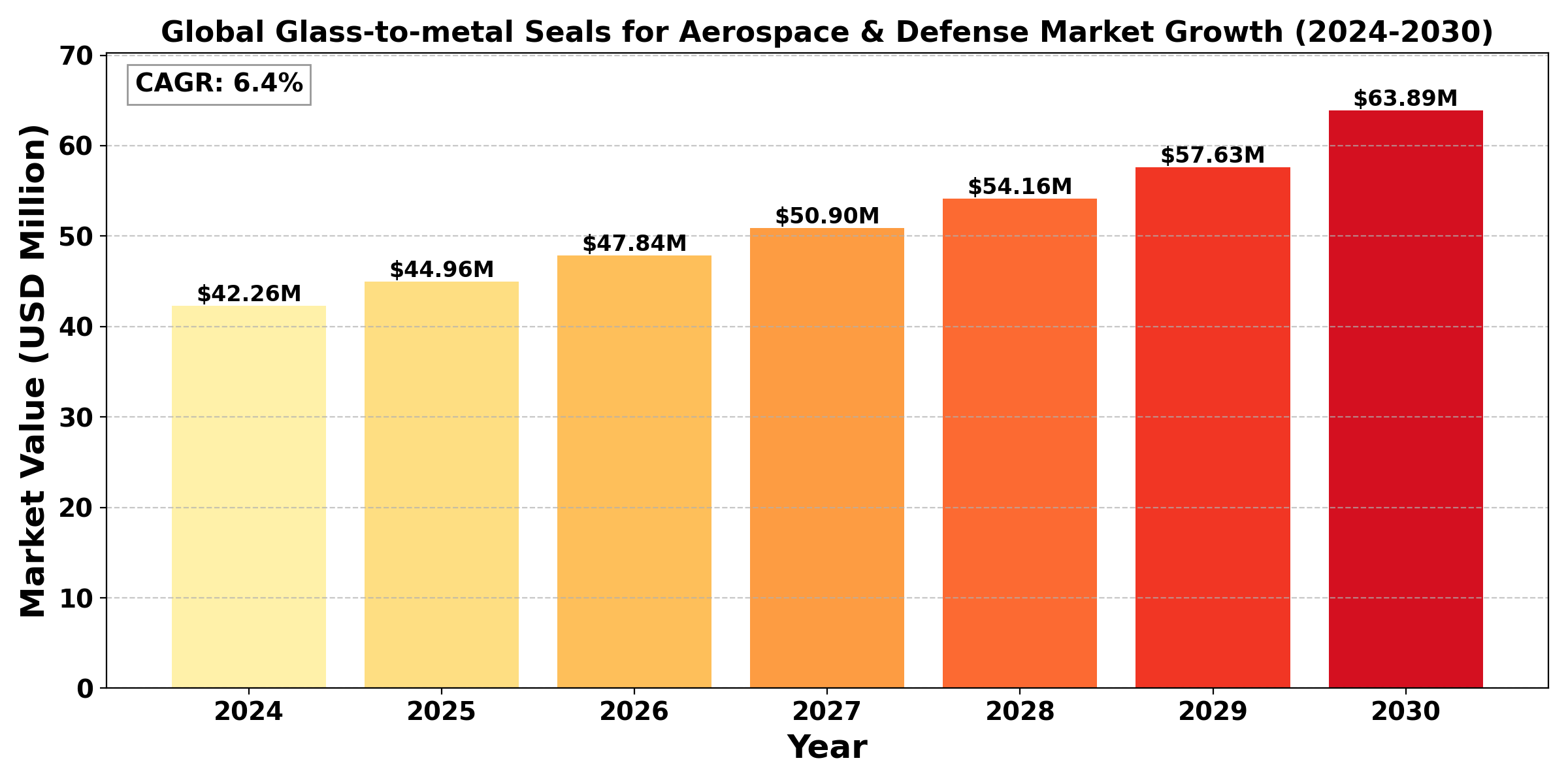

The "Global Glass-to-metal Seals for Aerospace & Defense Market" was valued at US$ 42.26 Million in 2024 and is projected to reach US$ 63.89 Million by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 6.4% during the forecast period (2024-2030).

A Glass-to-Metal seal typically consists of a metal housing, a molded glass-preform and one or several inner conductors. These components are melted in an inert gas atmosphere to form a hermetic seal in a special thermal process at approximately 1000?C. Glass to metal seals are widely used in aerospace & defense applications requiring hermeticity, including electronic warfare systems, missiles, satellites/space vehicles, radar systems, high vacuum, UAVs and ground-based communications, etc.

In the aerospace defense industry, the market for glass-to-metal seals is essential to maintaining the performance and dependability of numerous aircraft applications, including as sensors, electronic parts, and hermetic packaging. These seals are crucial for shielding delicate electronic parts from environmental elements that might negatively impact performance and longevity, like dust, moisture, and temperature changes.

By gluing glass to metal via a regulated heating process, glass-to-metal seals are created, which produce an impermeable, long-lasting barrier that can survive the harsh conditions commonly found in aerospace applications. In the defense industry, where performance and dependability are crucial and failure can have dire repercussions, this technology is especially crucial.

The need for strong, lightweight materials that can improve the performance of airplanes and other defense equipment has grown in the aerospace defense sector. Glass-to-metal seals are perfect for use in sophisticated avionics and electronic warfare systems because they offer superior thermal and electrical isolation. Furthermore, the need for premium seals that satisfy exacting military requirements is growing as defense companies keep spending money on updating and modernizing their current systems.

Segmental Overview

Matched Seals to hold the highest market share: By Type

Compared to compression seals, matching seals have the largest market share in the global glass-to-metal seals market for the aerospace and military industries. Matched seals are especially well-suited for high-performance aerospace applications since they are made for uses that call for exact alignment and fit between the metal and glass components. They are a popular option in vital aerospace and defense systems because of their capacity to produce a robust, dependable hermetic seal in the face of hostile environments, temperature swings, and pressure shifts.

Because of their exceptional performance qualities, such as their great electrical insulation and thermal stability, matched seals are in high demand. These characteristics are essential for safeguarding delicate electronic parts and guaranteeing the durability of systems utilized in military and aerospace applications. The desire for matched seals is anticipated to increase as defense contractors place a greater emphasis on system performance and dependability, hence cementing their position as the market leader for glass-to-metal seals for aerospace and defense.

Although compression seals are equally significant and have a place in some applications, they fall short of matching seals, which continue to dominate the industry in terms of both market share and demand.

Military Segment to hold the highest market share: By Application

Compared to civil applications, the military application has the largest market share in the global glass-to-metal seals market for aerospace and defense. The strict criteria for performance, longevity, and dependability in military systems—where malfunctions can have dire repercussions—are the main cause of this dominance.

Advanced technology and parts that must survive challenging conditions, such as high temperatures, vibrations, and electromagnetic interference, are frequently used in military applications. For delicate electronic components, glass-to-metal seals offer crucial protection, guaranteeing their longevity and operation under trying circumstances.

High-quality sealing systems that satisfy exacting military requirements are becoming more and more in demand as defense spending rises globally. The industry's demand for glass-to-metal sealing is further fueled by the emphasis on updating military equipment and integrating cutting-edge electronics.

While the civil aerospace segment also utilizes glass-to-metal seals, particularly in commercial aircraft and satellite applications, it generally has a smaller share of the market compared to the military segment. The unique demands and critical nature of military applications solidify their position as the leading application for glass-to-metal seals in the aerospace and defense market.

Regional Overview

The regional landscape of the global glass-to-metal seals market for aerospace and defense is predominantly led by North America, particularly the United States, due to its robust aerospace industry and significant defense spending. Major defense contractors and aerospace manufacturers in this region prioritize advanced sealing solutions for their critical applications, driving demand for glass-to-metal seals. Europe follows closely, with countries like Germany, the UK, and France investing in military modernization and advanced aerospace technologies, further enhancing the need for reliable sealing solutions. The Asia-Pacific region is also emerging as a key player, with increasing defense budgets and expanding aerospace sectors in countries like China, India, and Japan. While the Middle East and Africa hold a smaller share, rising military expenditures in these regions present opportunities for growth. Overall, the market is poised for expansion across all regions, driven by advancements in technology and the continuous demand for reliable aerospace and defense systems.

Competitive analysis

Recent Development

Elan Technology has lately advanced and achieved reputation. Notably, the business was chosen to participate in a research conducted by the Massachusetts Institute of Technology (MIT) that looked at the possibility of reviving American manufacturing. This demonstrates Elan Technology's position as a cutting-edge industry leader and its support of robust domestic manufacturing. Elan, which manufactures a variety of glass and ceramic components from its 90,000-square-foot factory in Midway, Georgia, is especially well-known for its use in high-performance industries like the industrial, defense, and aerospace sectors.

End Use industry Analysis

The end-use industry analysis for the global glass-to-metal seals market in aerospace and defense highlights the critical role of these seals in both military and civil aviation sectors. Glass-to-metal seals are crucial in the military industry for safeguarding delicate parts of a range of defense systems, such as electronic warfare, missile guidance, and avionics. Glass-to-metal seals are an essential component of defense equipment design because military applications require components that can endure severe temperatures, pressure fluctuations, and vibrations. The need for high-reliability sealing systems that satisfy exacting military requirements is being fueled by the growth in defense budgets around the world, particularly in the United States, Europe, and some regions of Asia.

Glass-to-metal seals are employed in commercial aircraft systems, like sensors and communication equipment, where safety and dependability are crucial in the civil aviation industry. Because they improve safety and help avoid system failures, these long-lasting sealing solutions are becoming more and more in demand as air travel continues to grow, particularly in emerging economies. Furthermore, the growing commercial and defense satellite industries are increasing demand for glass-to-metal seals because they offer the essential security against space climatic variables for sensitive electronic components. The market for glass-to-metal seals is generally experiencing steady expansion due to the aerospace and military industries, with developments in these fields further securing the technology's employment in a variety of end-use industries.

Industry Dynamics

Increasing demand for durable and reliable components

The growing need for dependable, long-lasting parts that can endure harsh climatic conditions is a major factor propelling the market for glass-to-metal seals in the aerospace and defense industries. Components used in aerospace and defense applications must function in high-stress conditions, which may include exposure to severe vibrations, pressure changes, and extremely high or low temperatures. These requirements are satisfied by glass-to-metal seals, which offer a strong hermetic barrier that shields vital mechanical and electrical components from outside impurities like dust and moisture that could reduce performance.

Technological developments in avionics and defense electronics, which depend on delicate, high-precision components, have increased the demand for dependability even more. Glass-to-metal seals offer materials with exceptional thermal and electrical insulating qualities as well as mechanical strength, which are essential for these applications. This specialized market segment is growing as a result of the increased need for high-performance sealing solutions that guarantee equipment longevity and durability due to rising defense expenditures and aerospace investments worldwide.

Industry Trend

Shift toward lightweight, high-durability materials

The move toward lightweight, highly durable materials to improve efficiency and decrease weight in aerospace and military applications is a noteworthy development in the market for glass-to-metal seals for these industries. The demand for increased mobility in military equipment and fuel efficiency in aerospace is driving this trend, which is forcing manufacturers to use cutting-edge materials that are both lightweight and sturdy. Furthermore, avionics and defense technologies are increasingly focusing on the shrinking of electronic components, which calls for more accurate and smaller seals to safeguard delicate equipment without adding bulk.

The increasing need for specialized and application-specific sealing solutions as a result of the intricate specifications of contemporary defense and aerospace technology is another development. Glass-to-metal seals are being customized for specialized uses, such as missile guidance and space exploration, where dependability and performance in harsh environments are essential. The creation of hybrid materials and other developments in materials science are also impacting seal designs to enhance their electrical and thermal characteristics. In crucial aerospace and defense applications, this personalization not only guarantees excellent performance but also encourages extended lifecycle costs and system reliability.

Industry Restraint

High manufacturing and material costs

The high production and material costs involved in creating high-performance, precision seals are a major barrier to the market for glass-to-metal sealing in the aerospace and military industries. It takes expensive raw materials, such specialty glass and alloys, as well as sophisticated manufacturing processes to create dependable seals that can endure harsh environments. The affordability and uptake of glass-to-metal sealing in projects with tight budgets are impacted by this high production cost, which is transferred throughout the supply chain.

Maintaining strict regulatory and quality standards is another issue the industry faces, particularly in the aerospace and defense sectors where any failure might have dire repercussions. This calls for stringent testing, quality assurance, and compliance protocols, which can increase expenses and prolong manufacturing schedules. The sluggish adoption of more recent, alternative sealing technologies, which may be more cost-effective than glass-to-metal seals but may be more desirable for less important applications, is another barrier. Together, these elements reduce the market's potential for expansion by limiting adoption in projects with tight budgets and erecting obstacles to entry for smaller producers.

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Type, Application. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

|

Attributes |

Details |

|

Segments |

By Type

By Application

|

|

Region Covered |

|

|

Key Market Players |

|

|

Report Coverage |

|