TOP CATEGORY: Chemicals & Materials | Life Sciences | Banking & Finance | ICT Media

Download Report PDF Instantly

Report overview

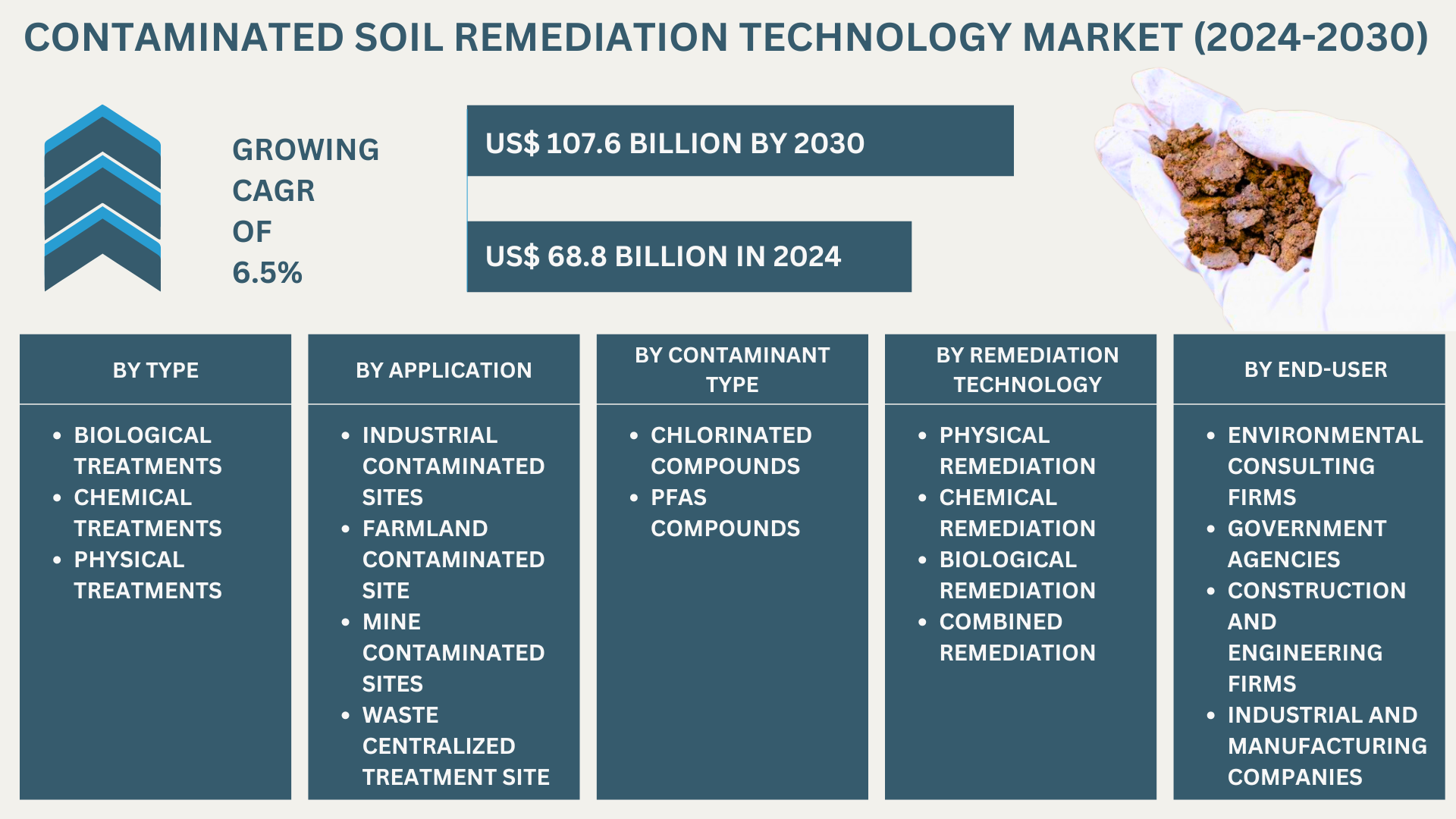

The Global "Contaminated Soil Remediation Technology Market" was valued at US$ 68.8 Billion in 2024 and is predicted to reach US$ 107.6 billion by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period (2023-2030).

Contaminated Soil Remediation Technology refers to a range of methods and techniques used to treat and remove pollutants or hazardous substances from soil, making it safe for the environment and human health. These technologies are employed to address soil contamination caused by industrial activities, agricultural practices, waste disposal, and accidental spills of chemicals or hazardous materials.

The study of contaminated soil remediation technologies focusses on methods and approaches for removing hazardous pollutants, such as heavy metals, organic contaminants, and other toxic elements, from contaminated soil. Stricter regulatory frameworks, a growing environmental concern, and the need to restore land for safe usage are the driving forces behind this industry. The technologies used include both in-situ and ex-situ techniques such soil cleaning, phytoremediation, thermal desorption, and bioremediation. The industry is distinguished by a constant stream of innovation aimed at enhancing the functionality, affordability, and ecological footprint of these technologies. To address site-specific difficulties, major participants in the business often work in conjunction with government organisations, environmental agencies, and industrial clients. The market is expanding as a result of urbanisation, developing industrial activities, and the demand for sustainable land control practice.

In terms of type the global contamination soil remediation technologies market has been segmented as Biological Treatment, Chemical Treatment, and Physical Treatment.

The most favourable market share is often held by biological treatments within the Contaminated Soil Remediation Technology market sector. This dominance is a result of the increased demand for sustainable and environmentally friendly soil remediation solutions. Biological treatments, like phytoremediation and bioremediation, use natural strategies using flora and microorganisms to absorb and degrade pollutants, either completely eliminating them or reducing their negative effects. Compared to chemical or biological treatments, these methods are typically more economical, demand less strength, and cause the least amount of environmental disturbance. Furthermore, because organic treatments have less of an impact on the environment, they are favoured in many regulatory regimes. The demand for biological soil remediation techniques keeps rising as governments and businesses place a higher priority on sustainable development and inexperienced technology.

In terms of Application the contaminated soil remediation technologies market has been segmented as Industrial Contaminated Sites, Farmland Contaminated Site, Mine Contaminated Sites, and Waste Centralized Treatment Sites.

By application, industrially contaminated regions usually hold the highest market share in the contaminated soil remediation technology industry. This is mainly due to the high frequency of pollution in industrial locations, where processes including waste disposal, chemical processing, and manufacture frequently result in widespread soil infection. Industrial websites are far more likely to contain a variety of hazardous elements that require advanced remediation technologies, such as petroleum hydrocarbons, heavy metals, and volatile organic compounds (VOCs). .. Moreover, industrial settings face particularly strong regulatory demands that drive the need for effective remediation strategies to meet compliance standards. The financial benefit of renovating commercial websites, which are frequently found in metropolitan or strategically important economic areas, also increases the need for soil remediation solutions in this area. The market share leader in commercial contaminated sites continues to be industries looking to reduce their environmental responsibilities and restore land for future use.

In terms of region, the contaminated soil remediation technologies has been segmented as North America, Europe, Asia Pacific, Middle East and Africa and South America.

|

Attributes |

Details |

|

Segments |

By Type

By Application

By Contaminant Type

By Remediation Technology

By End-User

|

|

Region Covered |

|

|

Key Market Players |

|

|

Report Coverage |

|

The competitive landscape of the contaminated soil remediation technology market is defined by a mix of global and local players, each vying to enhance their position in the market through innovation, joint ventures, and geographic expansion. Large organisations such as Veolia, Clean Harbours, and Golder Associates are market leaders due to their extensive portfolio of services, cutting edge technologies, and vast expertise in managing challenging remediation projects in a variety of industries. To keep a competitive edge, these companies frequently take advantage of their extensive global reach, potent R&D capabilities, and solid clientele.

However, local companies in regions such as Asia-Pacific and Europe also pose a serious threat, frequently specialising in specific maintenance methods that are adapted to regional environmental requirements and legal requirements. These organisations can also offer more cost-effective solutions by utilising their in-depth knowledge of local market dynamics and client requirements. Furthermore, cooperation between domestic and foreign companies is typical, accounting for the transfer of historical knowledge and the application of best practices in unique markets.

The contaminated soil remediation technologies market serves a variety of end-use industries, with industrial sectors, agriculture, mining, and waste management being the primary drivers of demand. The industrial sector—encompassing manufacturing, chemical processing, and oil and gas—accounts for a significant share of the market due to the high incidence of soil contamination from these activities.

The Agricultural Sector Accounts for Around 20–25% of the Market Demand for remediation technologies, driven by the need to restore arable land for safe food production and to comply with agricultural standards and regulations. Among these sectors, soil contamination from pesticides, fertilisers, and irrigation with polluted water sources is a major concern. The industrial segment accounts for about 35–40% of the total demand for remediation technologies, as these industries frequently deal with heavy metals, hydrocarbons, and other hazardous pollutants that require advanced treatment methods.

There is a projected change in the contaminated remediation industry towards ecologically friendly methods, particularly bioremediation and phytoremediation. These methods use natural processes to treat soil pollution, as opposed to more intrusive and chemical-intensive conventional methods. The process of bioremediation uses microorganisms, such as fungi, algae, or bacteria, to break down and metabolise pollutants into less toxic forms. This technology is well known for its low environmental impact and value-efficiency, and it is especially effective for organic pollutants like pesticides, solvents, and petroleum hydrocarbons. In the same way, phytoremediation employs plant life to absorb, collect, and restructure contaminants from the soil. Certain plant species have the ability to absorb natural chemicals, radionuclides, and heavy metals. These substances are either stored inside the plant tissues or changed into less toxic forms. This method not only aids in remediation however also enhances website aesthetics, as it integrates inexperienced flora into infected landscapes.

The growing adoption of these sustainable techniques is largely driven by heightened environmental awareness and stricter regulatory frameworks that demand greener solutions. As global priorities shift towards sustainability, these technologies align with broader goals of reducing environmental footprints, promoting ecological health, and advancing corporate social responsibility. Advances in biotechnology and plant science are continuously enhancing the efficacy of these methods, further accelerating their integration into mainstream remediation practices.

Large-scale soil contamination is mostly caused by rapid urbanisation and industrialisation, especially in emerging economies that are rapidly growing economically. Large amounts of pollutants are frequently released into the environment as industries grow and new metropolitan zones are developed. Numerous contaminants, such as heavy metals, solvents, hydrocarbons, and hazardous waste, are introduced into the soil by industrial operations such as production, chemical processing, mining, and waste disposal. Furthermore, polluted areas may be disturbed by building and land redevelopment initiatives, which may accelerate the spread of pollutants.

In emerging economies, where industrialization and urban expansion are occurring at an accelerated pace, the scale of soil contamination can be particularly severe. These regions often face challenges such as inadequate waste management infrastructure, limited regulatory enforcement, and rapid population growth, which further complicate soil pollution issues. The demand for land for residential, commercial, and industrial purposes drives extensive construction activities, frequently without adequate consideration for environmental impacts. This situation results in the accumulation of contaminants in soil, affecting land usability and environmental health.

One of the primary restraints in the contaminated soil remediation industry is the high cost associated with advanced remediation technologies. These costs encompass a range of expenses, including site assessment, technology implementation, and long-term monitoring. The initial investment required for sophisticated remediation technologies, such as thermal desorption, chemical oxidation, or advanced bioremediation methods, can be substantial. These technologies often involve expensive equipment, specialized materials, and complex procedures, which can drive up costs significantly. For complex or large-scale contamination projects, the financial burden is even greater. Detailed site assessments, including extensive sampling and analysis, are necessary to accurately determine the extent and nature of contamination. Implementing the chosen remediation technology often requires a substantial upfront capital investment, and the process can be lengthy, with ongoing operational and maintenance expenses. Long-term monitoring is also crucial to ensure the effectiveness of the remediation and to verify that contaminants have been adequately addressed, adding to the overall cost.

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides break down details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by types, applications, Contaminate type, Remediation Technology, end use. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.