The global automotive parts manufacturing industry plays a pivotal role in the automobile sector. It is responsible for producing the components that make vehicles functional, safe, and efficient. As the automotive industry undergoes rapid technological advancements, such as electrification, automation, and smart features, the automotive parts manufacturing market is also evolving. This blog will explore the state of the automotive parts manufacturing market, its key drivers, challenges, trends, and forecasts for 2024 and beyond.

Market Overview: Automotive Parts Manufacturing

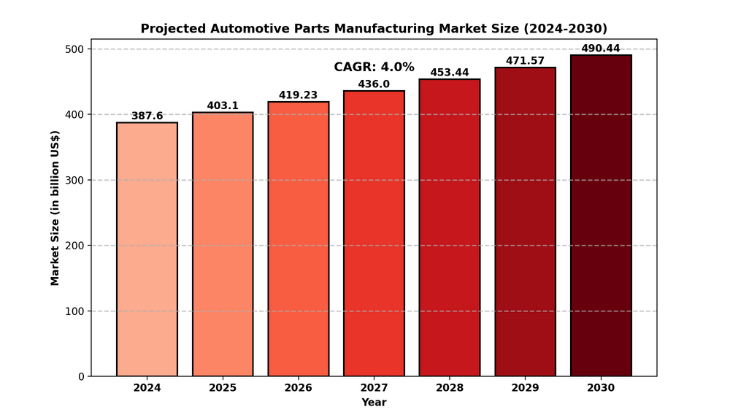

The Global Automotive Parts Manufacturing market size was valued at US$ 387.6 billion in 2024 and is projected to reach US$ 490.4 billion by 2030, at a CAGR of 4.0% during the forecast period 2024-2030.

Automotive parts manufacturing involves the production of essential vehicle components such as engines, transmission systems, steering mechanisms, braking systems, electrical systems, and body parts. These components are supplied to automotive OEMs (Original Equipment Manufacturers) and the aftermarket for repairs, replacements, and upgrades.

The automotive parts manufacturing market is essential for the production of all types of vehicles, including passenger cars, commercial vehicles, and electric vehicles (EVs). In 2024, the global automotive parts market was valued at approximately $1.6 trillion and is projected to grow steadily in the coming years.

Key Trends and Developments in the Automotive Parts Manufacturing Market

Shift Toward Electric Vehicles (EVs)

- One of the most significant trends in the automotive parts manufacturing sector is the shift towards electric vehicles. As governments worldwide introduce stricter emission regulations and consumers show a growing preference for sustainable transportation, automakers are investing heavily in electric vehicles. This shift is creating demand for new automotive components, such as electric motors, battery packs, and power electronics, which require specialized manufacturing processes.

- According to a report by the International Energy Agency (IEA), global electric car stock surpassed 16 million units in 2022, representing a 60% increase from 2020. The growth in EV adoption is expected to accelerate in 2024 and beyond, which will continue to fuel demand for specialized automotive parts.

Technological Advancements in Manufacturing Processes

- The automotive parts manufacturing industry is increasingly adopting advanced technologies such as robotics, artificial intelligence (AI), and 3D printing to improve efficiency and reduce production costs. AI and machine learning are being used to optimize production schedules, enhance quality control, and predict maintenance needs in manufacturing plants.

- 3D printing is also gaining traction for producing prototypes and low-volume parts. This technology enables manufacturers to produce complex components with minimal waste, which can reduce costs and production time.

Growing Demand for Lightweight Materials

- As vehicle manufacturers strive to improve fuel efficiency and reduce emissions, there is a growing demand for lightweight materials. Materials such as aluminum, carbon fiber, and high-strength steel are increasingly used in automotive parts manufacturing. These materials help reduce the weight of vehicles, which, in turn, improves fuel economy and extends battery life for electric vehicles.

- For example, Tesla's Model 3 is known for its lightweight construction, incorporating a significant amount of aluminum to reduce weight while maintaining structural integrity.

Automotive Aftermarket Growth

- The automotive aftermarket plays a crucial role in the overall automotive parts manufacturing market. With the rising age of vehicles on the road, especially in developed markets like the U.S. and Europe, the demand for aftermarket parts such as replacement components, accessories, and performance upgrades is growing. The global automotive aftermarket was valued at $387.6 billion in 2024 and is expected to reach $490.4 billion by 2030, growing at a CAGR of 4.0% from 2024 to 2030.

Supply Chain Challenges

- The automotive parts manufacturing market faces significant supply chain challenges, particularly in the aftermath of the COVID-19 pandemic. Global semiconductor shortages, transportation bottlenecks, and raw material price fluctuations have led to production delays and increased costs. Manufacturers are now focusing on diversifying supply sources, investing in local production capabilities, and improving supply chain resilience to mitigate these risks.

Download Free Sample Copy >>> "Automotive Parts Manufacturing Market"

Market Segmentation

The automotive parts manufacturing market can be segmented based on several factors, including:

Vehicle Type:

-

Passenger Cars: This segment remains the largest, accounting for a significant portion of automotive parts demand.

-

Commercial Vehicles: Includes trucks, buses, and vans, which require specialized parts for heavier duty and longer operational lifespans.

-

Electric Vehicles (EVs): With the rapid rise of EVs, this segment is expected to witness the highest growth in the coming years.

Component Type:

-

Powertrain Components: Includes engines, transmission systems, and drivetrains.

-

Chassis and Suspension Components: Steering systems, axles, brakes, and suspension parts.

-

Electrical Components: Battery systems, sensors, infotainment systems, and lighting.

-

Body and Exterior Parts: Includes panels, windows, mirrors, and bumpers.

Geography:

-

North America: Home to major automotive manufacturers such as General Motors, Ford, and Tesla. The U.S. also leads the electric vehicle market.

-

Europe: A key hub for high-end automotive parts manufacturers, especially in Germany, which houses automakers like Volkswagen, BMW, and Mercedes-Benz.

-

Asia-Pacific: The largest market for automotive parts, particularly China, Japan, and South Korea. The region is expected to lead the global automotive parts market, especially in the electric vehicle sector.

Key Market Players

Some of the key players in the global automotive parts manufacturing market include:

-

Magna International Inc. – A leading supplier of automotive systems, including powertrain, chassis, and body parts.

-

BorgWarner Inc. – Known for manufacturing powertrain components such as turbochargers, transmissions, and electric vehicle parts.

-

Robert Bosch GmbH – A major player in the supply of automotive parts, including fuel systems, sensors, and safety technologies.

-

Continental AG – A prominent supplier of automotive parts, particularly in the areas of tires, brakes, and automotive electronics.

-

Aisin Seiki Co., Ltd. – Known for its drivetrain, braking, and chassis systems.

Market Forecast: 2024 and Beyond

The global automotive parts manufacturing market is expected to grow at a steady rate over the next several years. According to the market is projected to expand at a CAGR of 4.0% from 2024 to 2030, reaching a valuation of approximately $ 490.4 billion by 2030.

-

Growth Drivers: The shift towards electric vehicles, demand for advanced materials, technological innovations in manufacturing, and growth in the automotive aftermarket.

-

Challenges: Supply chain disruptions, rising raw material costs, and increasing competition among global suppliers.

Download Free Business Sample Report>>> "Automotive Parts Manufacturing Market" Click Here